The R&D Response to COVID-19: What Can We Learn for the Vaccine Ecosystem?

Introduction: An Unprecedented Response

The COVID-19 crisis has generated an unprecedented research and development (R&D) response across the life sciences sector. From a near standing start in February 2020, more than 700 projects are now under way, examining vaccines, antivirals and other treatments to manage and prevent the spread of the disease and treat severely affected patients (Biotechnology Innovation Organization, 2020).

While some of these efforts have repurposed existing technologies, almost half represent novel R&D initiatives. Of the 170-plus vaccine projects listed by the World Health Organization (WHO), 95 percent involve totally new vaccines (the remainder have been repurposed).

The remarkable scale and speed of the response has been far beyond anything seen in previous pandemics. As of summer 2020, nine vaccine candidates are already in Phase 3 trials, with 25 more close behind, and the testing pipeline carries some 130-plus preclinical candidates (WHO, 2020). With so many shots at the target and the diversity of R&D platforms being explored, confidence is rising that we will see a successful vaccine by the end of 2020 or early 2021. Indeed, by then we may see multiple types of vaccines available to the global community to contain the catastrophic global impact of this pandemic.

A Developer’s Perspective: Learning from COVID-19?

The Sabin-Aspen Vaccines Science & Policy Group commissioned research from global management consultancy Kearney to better understand the vaccine R&D response to the COVID-19 crisis, with a particular focus on organizations actively involved in developing vaccine candidates. The study looked at the makeup of the organizations driving the research effort; their motivations, ambitions and funding; and the unique challenges that they have encountered.

The objective is to understand whether this is a one-time response or whether it offers insights for effectively preparing for future pandemics and perhaps creating an R&D ecosystem better able to rapidly and effectively address the world’s greatest health challenges.

The research was conducted in July and August 2020, using surveys and interviews with companies and organizations involved in COVID-19 vaccine development as well as online research.

We approached more than 100 vaccine developers and received responses from 17 organizations. The survey respondents represent the diversity of the R&D effort around the globe and include a mixture of government-owned, private and publicly held entities. They include two companies that have clinical candidates; the remainder are testing products in a preclinical phase. The typical respondent had been established for over 10 years, and all have been in operation for at least two years. All but one had experience in developing vaccines, and the great majority had previously marketed vaccines or conducted extensive research on them. The survey respondents provide a credible snapshot of small biotech and midsize firms, as well as insights from large, established vaccine players.

As with all COVID-19 research, the data reported in this paper can only be accurate at the time of writing. At this stage, findings can be considered “directional,” and more extensive research will undoubtedly add to the knowledge base.

The majority of our research was based on the WHO-published vaccine pipeline as of July 24, 2020, supplemented by analysis from the Milken Institute. To ensure the most current picture possible, we also drew on WHO pipeline data as of September 9, 2020, to update some of the information; these updates are referenced in the citations.

The paper looks first at the composition of the research response effort: Who are the players, where do they come from, what technologies are they exploring and what has motivated them to get involved? We then explore how efforts are being resourced: What are the funding sources, what activities does the funding cover, what role do partnerships and collaboration play in the response effort and what are the challenges? The final section of the paper explores what can be learned from the current response effort, both during the immediate crisis and for future pandemic and health research efforts.

The Players and the Platforms

A Broad R&D Response Covers Both Conventional and Novel Approaches

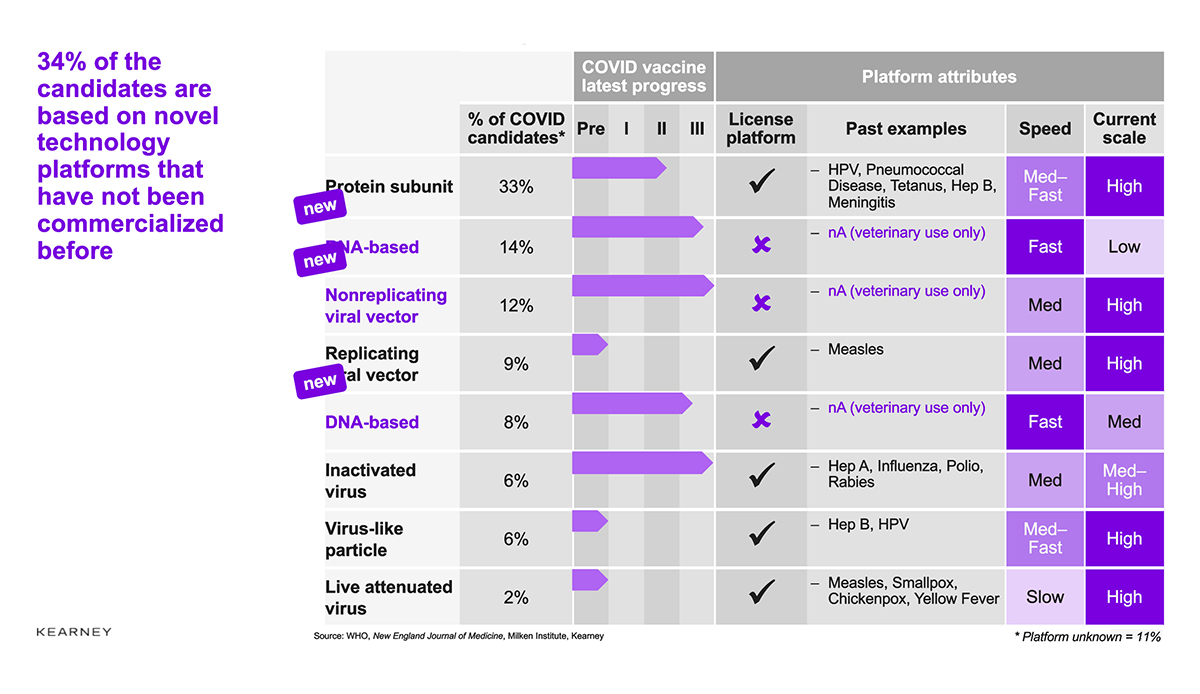

The COVID-19 pipeline currently consists of 170-plus candidates at various stages of development and spread across different technologies and platforms (see Figure 1) (Kearney et al., 2020). Sixty-six percent of the pipeline consists of “conventional” technologies, mainly protein subunit vaccines (about one-third of all candidates), replicating viral vectors, and inactivated viruses. The remaining 34 percent of the candidates involve novel technology platforms, primarily based on RNA and DNA and nonreplicating viral vectors.

Figure 1. COVID-19 Vaccine platform overview

Source: WHO; New England Journal of Medicine; Milken Institute; Kearney, 2020.

The hope that RNA- and DNA-based platforms can promote rapid development is borne out by the fact that 10 out of the 34 candidates in clinical development employ those platforms. The Chinese experience with inactivated virus approaches, however, shows that conventional technologies can also be used for rapid development (WHO, 2020).

The potential risks of investing in novel platforms with no prior track record has been debated, given questions both about efficacy and safety and about economic and scale-up viability (Van Riel & de Wit, 2020). Overall, however, the COVID-19 R&D response has created a balanced portfolio of research options, although they do not all attract the same level of funding, as discussed later.

High-Income Markets Dominate Research Efforts, but Asian Developers Are Well Represented

Although there is a concentration of research activity in high-income countries where the lead developers are based (accounting for 69 percent of candidates), the effort is truly global. Thirty percent of lead developers come from upper-middle-income countries, especially in Asia, where China and India are dominant. Lower-middle-income countries are responsible for a dozen or so candidate projects through developers that include BioNet (Thailand) and the National Research Center (Egypt) (WHO, 2020). This mismatch between disease burden and research location is obviously a concern, especially given supply-chain scaling constraints and the perceived threat of vaccine nationalism.

Participation Across the Innovation Ecosystem, From Experts to Novices, Motivations Vary

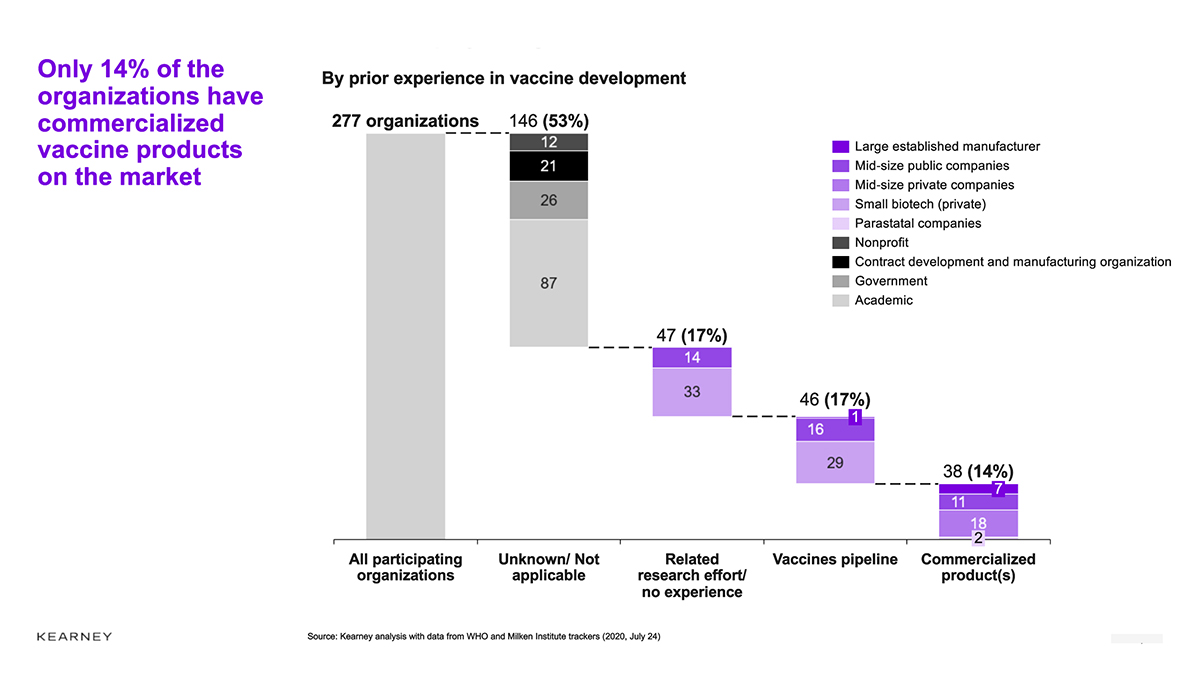

More than 270 organizations are involved in developing the 170-plus COVID-19 vaccine candidates registered on the WHO database (WHO, 2020), and our analysis shows that participation comes from across the innovation ecosystem (see Figure 2). The development landscape includes large, established manufacturers and vaccine players, as well as smaller biotechs, startups and academic institutes (the latter group collectively represents almost 60 percent of the organizations involved). Government agencies and parastatal companies (i.e., state-owned or state-directed companies) also play an important role, particularly in middle-income countries.

Figure 2. Individual player segmentation

Source: Kearney analysis, with data from WHO and Milken Institute trackers, July 24, 2020.

Perhaps surprisingly, experience does not appear to be a barrier to getting involved. Based on our analysis, only 14 percent of the organizations have commercialized vaccine products on the market; another 17 percent have a developed vaccine pipeline but have yet to bring a vaccine successfully to market. A further 17 percent have related experience with the technology involved (e.g., DNA and RNA) but no previous forays into vaccines. We have not found evidence of prior experience in vaccine development or directly relevant platforms for the remaining 53 percent of players, mostly academic institutions. It is worth noting that most of the 34 clinical candidates under development are driven by organizations with proven vaccine development or commercialization experience (WHO, 2020). The broader involvement that is driving a lot of the preclinical development effort could fuel future waves of innovation.

Prior Vaccines and Pandemic Experience Accelerate Engagement

Our survey offers some insights into why organizations engage in the effort. Most of our respondents moved rapidly, with 80 percent having programs up and running by March. Indeed, several were already active in January, before a global pandemic was formally announced. A relatively smaller number joined the race later, between April and July 2020.

The reasons for getting involved varied greatly, but half the respondents had existing related research and platforms that could be easily repurposed. Early identification and publishing of the RNA sequence accelerated the response effort. COVID-19 prompted a totally de novo research initiative for only a small minority of respondents, typically motivated by the desire to rapidly build capability in new platforms. Strikingly, nearly all our respondents had responded to prior pandemics, reporting experience with Zika, Ebola, MERS, SARS, H1N1, or global influenza initiatives. Experience with a single type of platform did not seem to be a predeterminant for involvement. Most respondents had already developed their “pandemic response muscles” and were aware of the challenges and stakeholder environment, response timeline and required processes.

Commercial market potential was also a key consideration. Most of our respondents hope to see their projects through to commercialization. Advanced market commitments have played an important role in signaling future market demand and are increasingly providing pricing clarity.

Key reasons why some companies delayed their entry into the research, particularly emerging market developers, were the inability to access funding and lack of access to and familiarity with new technology platforms.

Funding The COVID-19 Response

$10 Billion in Health Funding Commitments Mobilized, Focused on Front-Runners and Novel Approaches

The COVID-19 pandemic response has mobilized considerable funding commitments. The three main funding blocs, which often overlap, are development funding and grants, co-investment in manufacturing infrastructure development and advanced market commitments.

Many of the headlines have focused on the multibillion-dollar commitments made by the U.S. government and its Biomedical Advanced Research and Development Authority (BARDA) since the earliest days of the pandemic. Total BARDA grants and advance commitments now exceed $10 billion (The COVID-19 Health Funding Tracker, 2020), with more than 85 percent of that going toward vaccine development and manufacturing (BARDA, 2020a). Significant additional funding vehicles include the Coalition for Epidemic Preparedness Innovations (CEPI), with current COVID-19 funding commitments of $1.2 billion (The COVID-19 Health Funding Tracker, 2020), and the Bill & Melinda Gates Foundation. As well, there are advanced market commitments from the European Union and individual governments, including the United States, Canada and the United Arab Emirates, and the COVAX initiative co-led by the WHO, Gavi and CEPI (Gavi, n.d.). In total, estimates suggest that more than $2.3 billion has been committed to the COVID-19 vaccine response through these channels, and that figure is rising (The COVID-19 Health Funding Tracker, 2020).

Development timelines and novelty have been primary criteria for BARDA and CEPI investment, so the primary beneficiaries of this investment have been the front-running candidates that use novel technologies (Cohen, 2020). While funding devoted to new technologies has no certainty of return, its availability does reflect interest in platforms that might be applied in other pandemics, the promise for both COVID-19 and other research purposes, and a national interest in building excellence in new areas of science and manufacturing (BARDA, 2020b). Our survey response suggests that the same considerations apply to private equity investors. The funding ambition therefore goes well beyond COVID-19, potentially at the cost of backing a more balanced portfolio of candidates to respond to COVID-19 itself.

Readily Available Resources for Early Development, Extra Funding Required for Scaling

A more mixed pattern of funding approaches emerges when we look beyond the front-runners to preclinical candidates and the next wave of innovation. Most of our respondents are funding current efforts with a mixture of external and internal funding, and several are fully internally funded; only a few depend solely on external funding.

Having existing funding in place and the ability to redeploy existing project resources most likely accelerated the COVID-19 response effort. Most of our respondents either already had projects in the area or, more commonly, were able to redeploy teams working on other projects toward the COVID-19 response at little incremental cost, at least for proof of concept and early development work.

Only a few of our respondents mobilized entirely new teams that required immediate net new expenditures. Most have funding commitments of less than $100 million, and the majority have less than $50 million, although the more advanced clinical projects have funding in excess of $500 million. For most of our respondents, current committed funding covers the proof-of-concept stage, up to smaller-scale Phase 1 and Phase 2 clinical trials. Only in a minority of cases could existing funding extend to financing Phase 3 pivotal trials. Existing funds also seem to cover manufacturing scaling and technology transfer in 60 percent of cases. All told, half of our respondents appear to be fully or nearly fully funded, while the rest will require additional funding, at a level that matches their existing funding commitments, to complete development and manufacturing scale-up.

The Role of Partnering in the Response

Partnering is a significant feature of the vaccine R&D COVID-19 response, with an average of 1.5 organizations involved in each project. Our respondents generally report a higher level of collaboration than is typical for similar programs, and the speed at which teaming has evolved and the central role that academic institutions play in developing the science are striking features.

Half the Vaccine Candidates Developed in Partnership, With Academic Institutions the Main Scientific Partner

Our analysis indicates that about half the COVID-19 vaccine candidates involve some form of development, manufacturing or commercialization partnership, including most of the 34 clinical candidates (see Figure 3) (WHO, 2020). This reveals that both solus and collaborative research approaches are being used equally across the continuum of the COVID-19 response.

Figure 3. Segmentation of partnership

Source: Kearney analysis with data from WHO and Milken Institute trackers, July 24, 2020.

Of the 90 development candidates currently in partnership, 63 percent involve two partners while 21 percent involve three partners, and the balance have four or more, including the Oxford University and AstraZeneca candidate, which has an extensive network of local manufacturing agreements.

Partnerships principally fall into two categories. R&D partnerships between two research entities account for almost half of all the partnering activities; research and manufacturing partnerships that involve a research entity and a clinical development, manufacturing and commercialization player account for just over 40 percent.

The most common partnering combination is between an academic or not-for-profit research entity and a development, manufacturing and commercialization partner, which account for just under half of all partnering models. Partnerships between two commercial players account for 23 percent of partnerships.

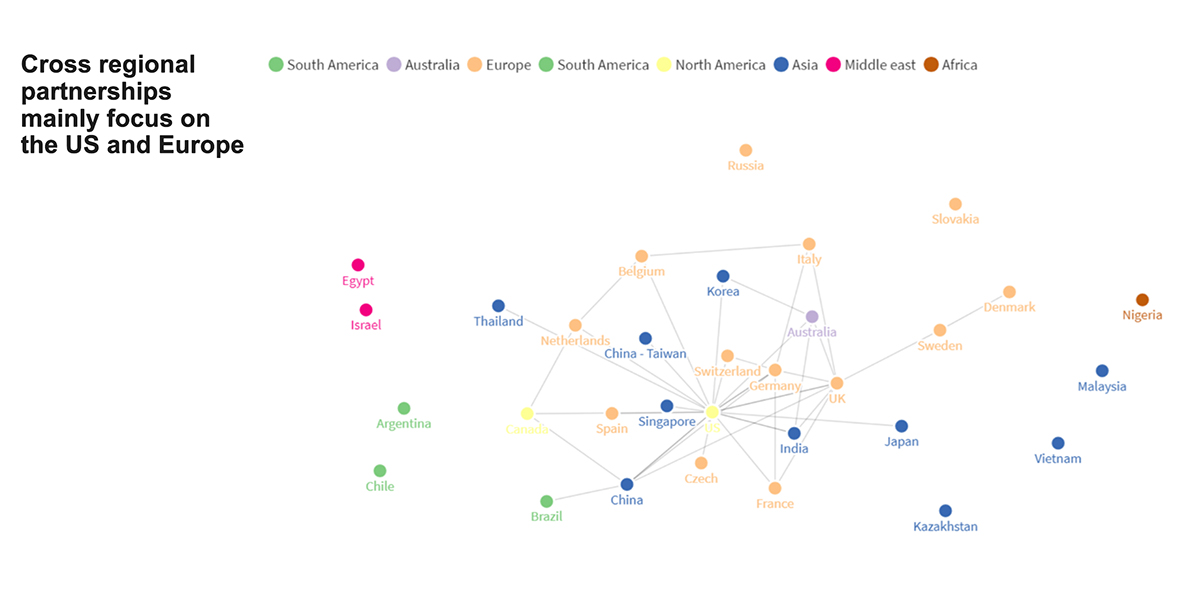

Many Partnerships Cross Borders, Mainly Between the United States and Europe or Within Europe

Cross-regional partnerships account for almost 40 percent of all partnerships. International teaming involving a U.S. player is the key model, accounting for 79 percent of these cross-regional partnerships. Intraregional partnerships, primarily in Europe, account for 17 percent of partnerships. Developers at the “periphery,” such as Egypt, Israel, Argentina, Chile, Russia, Nigeria, Malaysia and Vietnam, seem to be significantly less well-connected and do not appear to be partnering beyond their borders at this stage (see Figure 4).

Partnerships Are Driven by the Need to Access Capability, Share Risk and Achieve Scale

Our survey respondents are considering additional partnerships both for research and for manufacturing and commercialization purposes. Research partnering is focused on accessing core science, delivery systems and technologies. As already noted, most respondents are committed to seeing their projects through to commercialization, intend to market the product themselves or in partnership, and report having sufficient manufacturing capabilities to scale in response to demand. Their reasons for partnering are to achieve further manufacturing scale and geographical reach and to de-risk the commercialization effort, with many recognizing that there is more than enough potential demand to be shared among partners.

Six Months Into the Pandemic: What Works, What Does Not

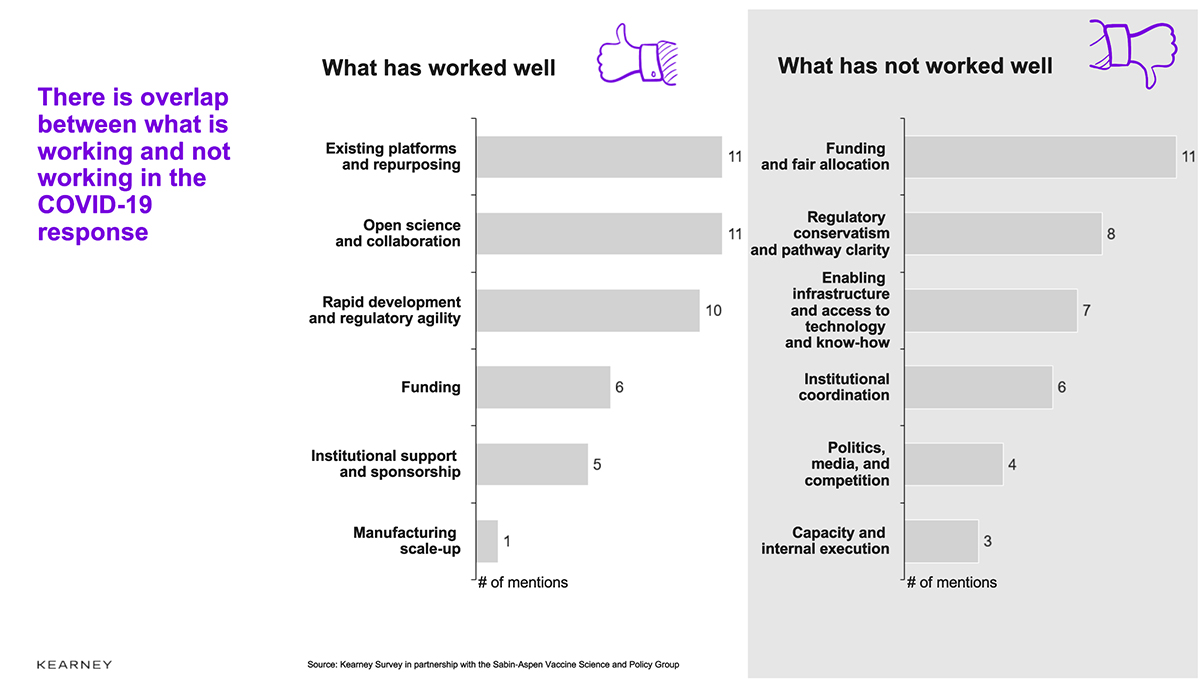

The COVID-19 vaccine R&D response has been moving extremely rapidly, mobilizing considerable scientific and financial resources and rapidly developing new institutional mechanisms. An impressive pipeline has been created at unprecedented speed, with the hopes of the world pinned on its success. The overall message from our respondents is that the early response has worked well, even if the institutional mechanisms have not always been transparent (see Figure 5).

But concerns remain about the next phase of the response and the legacy of a larger Western-driven scientific endeavor, especially as it pertains to global equity and resources to scale. This is very much the time to take stock, both to inform the current pandemic response and to strengthen future responses.

A number of key themes emerge from survey findings:

- Scientific preparedness and collaboration

- Regulatory clarity and agility

- Funding availability and access

- Institutional coordination and transparency

Figure 5. What has worked well and what has not

Source: Kearney Survey in partnership with the Sabin-Aspen Vaccine Science and Policy Group, 2020.

Scientific Preparedness and Collaboration

Availability of project resources, platforms and early collaboration enabled a rapid jump-start. All our respondents highlighted the speed and effectiveness of the initial development response. From the early dissemination of the RNA sequence of the virus to the rapid and effective sharing of scientific results, including prepublication results, the response was characterized by a high level of rapid information sharing, openness and transparency. The many players involved in the effort further amplified collaboration opportunities. As well, the availability of relevant platform technologies and capabilities, combined with an institutional openness to consider novel approaches (such as DNA and RNA platforms), helped to speed up early development activities.

The prior commitment of the WHO, CEPI and other global funders to related fields of research created a body of know-how that promotes confidence about moving rapidly in the early stages of the pandemic response. However, respondents also commented on the lack of global scientific policy on research priorities and the absence of a “pandemic research readiness” response plan. That absence allowed funders to drive priorities perceived to be biased toward rapid, novel platform technologies rather than conventional approaches. A centralized view of the target technologies both for the immediate and potentially longer-term response would have been helpful, especially one that considered the appropriate role and balance between conventional and novel technologies and opportunities to mobilize development efforts beyond the most obvious markets.

In practical terms, the speed of the response was driven by the fact that companies had resources already devoted to research that could be rapidly redirected to COVID-19 in light of the public health imperative and commercial potential.

Respondents highlighted several development bottlenecks, however. Among them were limits to the testing infrastructure (e.g., laboratory analysis and assays), supply chain disruption of critical materials such as reagents and competition for the resources of clinical research organizations (CROs). A key learning opportunity is the importance of having a ready development infrastructure.

Looking forward, respondents expressed some concern about the continued open sharing of information, particularly as some candidates enter pivotal trial phases and move nearer to market. Similarly, information on new strains has reportedly not been as prompt as it was at the outset of the pandemic.

Regulatory Clarity and Agility

Rapid regulatory engagement and openness to agile methods, but more end-game clarity needed. Along with openness, collaboration and the ready availability of resources and science to fast-track programs, early regulatory engagement was critical to the speed and quality of the initial response, particularly to accelerate preclinical development. Regulators were accessible, engaged and flexible about embracing new concepts, particularly for early-stage development candidates, and they have supported accelerated and dynamic clinical trial designs. Expedited reviews have ensured rapid progress at key decision points.

As projects move to more advanced stages of development, our respondents share a number of concerns about the clarity of the regulatory process. There is a perception that the key regulatory authorities (mainly the Food and Drug Administration) remain conservative, particularly in relation to novel compounds as they move beyond proof of concept into large-scale trials. Equally, there are concerns that political interference could compromise safety standards.

Also worrisome is the limited guidance on the target product profile and technology platform and the perceived lack of clarity on the primary clinical endpoints necessary to demonstrate efficacy. There continues to be ambiguity about the regulatory route to market and the approval requirements both for emergency use and mass immunization. The challenge is even greater outside the major regulatory jurisdictions.

Coordination of global clinical trials also remains a critical issue, particularly at the scale of the clinical trials needed to access high-incidence populations and the likelihood that the branching of different COVID-19 strains will require an assessment of relative efficacy in different populations and cohorts.

Funding Availability and Access

Major funding flows mobilized, but allocation not transparent or evenly spread. Survey respondents recognize the sea change in the adequacy of funding to support the COVID-19 vaccine R&D response, a rarity for some developers. However, funding remained a key concern for ultimate program success, especially as related to biases in how resources are allocated, both in terms of geography and technology.

Most of the mobilized funding has been in the United States, and to a lesser extent Europe, and national programs in China and Russia. In many instances, national policies and priorities are perceived to be dictating the direction of the scientific development. There is a well-founded perception that a considerable share of the funding has gone into novel (e.g., DNA and RNA) or strategic technologies, rather than conventional technologies, with an eye to speed and scientific innovation beyond the COVID-19 response. Respondents highlight the risk that the current funding approach may create a new vaccine oligopoly consisting of the early winners of the COVID-19 vaccine race. Decision making has not always been transparent, and limited justification has been provided when developers have had their applications rejected.

Looking toward the next phase of the response effort, access to funding and resources remains the main concern. Given that only a minority of our respondents are fully funded for development and scale-up, most would need to raise capital at least comparable to what they had previously raised to complete their programs. Working capital to fund Phase 3 scale-up clinical trials is a particular concern. Some of the primary funders, including BARDA, CEPI and academic grantors, typically do not provide cash funding for the later clinical development phases and only selectively to build manufacturing capacity. In the absence of institutional funding, our respondents are looking for commercial partnerships to share the risk. A key concern for several developers is the continued availability and willingness to provide funding after one or several vaccines are approved. There is a perception that funding will rapidly contract and that many projects will be unable to progress beyond proof of concept or early clinical development.

Institutional Coordination and Transparency

While multilaterals prepared the ground, national governments have been the game changer. Beyond the immediate context of regulatory engagement and funding, institutional coordination was not a primary factor for survey respondents. After the early preparatory work by the WHO and CEPI, the real impetus for the response was the recognition by national governments of the urgency and scale of the issue. The role of the U.S. government has drawn attention away from COVAX as the sole response platform, and there are analogous approaches by other national governments to create and power the existing pipeline. Despite all the issues of transparent decision making and the risks of political interference, Operation Warp Speed in the United States is perceived as a game changer, providing focus and prioritizing resources on a narrower portfolio of potential winners.

One of the shortcomings of a government-driven response is that it inevitably fragments the quality of the global effort. Our survey respondents highlighted shortcomings at different levels, from the absence of a coordinated and balanced vaccine research strategy to inform development efforts through the limited availability of research funding outside the major advanced centers.

Looking forward, the infrastructure for global trials and recruitment is perceived to need more coordination, as does the process for regulatory approval outside major established jurisdictions. These are immediate opportunities for action.

The COVID-19 Vaccine R&D Response and the Future of Vaccine Development

The Bar for a Quick Response to a Pandemic Has Been Raised, but Trust Is at Stake

The COVID-19 vaccine R&D response is recognized by our respondents as having a lasting impact on how vaccine development occurs in the future:

- The demonstrated speed at which products have been developed will change expectations of how quickly researchers and industry can respond

- The agile regulatory response and openness to in-line decision making and dynamic clinical trial designs have accelerated the time to market and taken years out of the development cycle

- COVID-19 has raised global institutional and public awareness of the essential role that vaccines continue to play in the public health response, unlocking exceptional funding

- If the current pipeline of candidates is successful, it will validate platform technologies and especially DNA, RNA and viral-vectored technologies as being able to provide a rapid response and amplify financial support for ongoing vaccine research in this area

The COVID-19 vaccine challenge has shown developers the potential speed and agility of the development process. For vaccine developers outside developed markets, it has also highlighted the important role of wealthier nations in any major pandemic response from scientific, policy and funding perspectives. Several respondents from middle-income markets mentioned the need to strengthen academic and commercial ties, especially with the United States but also with Europe.

However, the current response has been highly skewed toward large investments in unproven technologies, and our respondents shared concerns about political interference, transparency of decision making, independence of the regulator, and fairness and equity in the distribution of resources. If these programs succeed, it will redraw the vaccine landscape to the detriment of other, perhaps more conventional approaches, which are the mainstay of many middle-income and emerging-market vaccine players.

Finally and importantly, the trusted relationship with the public is finely balanced, and the combination of a growing anti-vaccination movement, the association of speed with risk, and the potential for inequity in how an eventual vaccine is distributed and priced could, if not carefully managed, ultimately work against the global vaccine agenda.

Conclusions and Recommendations

The COVID-19 vaccine response has mobilized resources on a scale and timeline that have never been seen in the context of a public health crisis.

Recent experience with pandemics, and, particularly, investment in platform technologies have strengthened the response muscle, supported by regulators and other governmental institutions that recognized the importance of immediate and agile decision making.

The scale and impact of COVID-19, the rapid global spread of the pathogen, the number of deaths worldwide and the huge economic costs and disruption of lockdowns have made curbing the pandemic an imperative. We are operating in an environment in which governments will do whatever it takes, with money no object. Companies, academic institutions and individuals have been highly motivated to redirect and repurpose existing efforts to respond to the pandemic.

While the unprecedented combination of factors that drove the COVID-19 response may not soon be repeated, lessons can be learned and embedded into the pandemic, epidemic and endemic vaccine response playbook. We propose the following recommendations for consideration:

- Research strategy: Several of our respondents highlight the fact that while most countries have a pandemic readiness plan, these plans do not contain a strategy for managing the therapeutic and immunization research response. This is seen as a critical gap. There is a need for a clear research response readiness strategy and also for securing very early (pre-pandemic) research advice to jump-start collaboration. Many researchers began their development before COVID-19 was officially declared a pandemic, even prior to its known spread outside of China.

- Regulatory agility, coordination and end-game clarity: The current response has shown how regulatory timelines can be dramatically accelerated and how developers can match their pace. However, early definitions of clinical endpoints and the target product profile/technology platform are needed to provide clarity and transparency on the full route to market for developers. Greater global regulatory coordination is also required to align decision making outside the major jurisdictions. Rather than revert to previous timelines and attitudes toward risk, there is an opportunity to institutionalize the regulatory approaches developed for the COVID-19 response — particularly the demonstrated speed, agility and openness — for future pandemic, endemic and epidemic vaccine development. This could dramatically reduce the barrier to entry for future vaccines, improving innovation, choice and competition.

- Warp speed for the world: Multiple attempts have been made to create global funding platforms for pandemic response, including the establishment of CEPI. However, the involvement of national institutions has been a game changer. Our survey indicates funding requirements in the realm of $100 million to $200 million for early development up to scaling and in excess of $500 million for full scaling, pivotal trials and manufacturing build-out. A pipeline of 20 or more potential candidates or shots on target (as we currently have for COVID-19) would require a funding platform of $5 billion to $10 billion or more and rigorous selection of winners.COVAX is designed to provide

exactly that, and it will be critical to identify successes and setbacks with CEPI, COVAX, Operation Warp Speed and other national approaches to inform future pandemic responses. Specifically, we need to know whether multiple financing vehicles are beneficial and create more options or dissipate effort. At a minimum, a pump-primed, ready-in-waiting global platform will benefit future responses. In principle, the same warp-speed philosophy could also be applied to mobilize focused research to address other challenges, such as epidemic and endemic diseases, possibly with annualized R&D campaigns and funding efforts.

exactly that, and it will be critical to identify successes and setbacks with CEPI, COVAX, Operation Warp Speed and other national approaches to inform future pandemic responses. Specifically, we need to know whether multiple financing vehicles are beneficial and create more options or dissipate effort. At a minimum, a pump-primed, ready-in-waiting global platform will benefit future responses. In principle, the same warp-speed philosophy could also be applied to mobilize focused research to address other challenges, such as epidemic and endemic diseases, possibly with annualized R&D campaigns and funding efforts. - Balanced technology portfolio: COVID-19 is a testing ground for platform and DNA and RNA technologies. However, the pipeline has clearly shown that other candidates are equally amenable to rapid development. The appropriate balance of novel and conventional technologies needs to be considered, as does facilitating the opening of platforms to ensure broader and more immediate access to developers around the world. Thought also needs to be given to the extent to which institutional funding obligations for pandemic responses should be accompanied by some commitment to intellectual property sharing, without comprising the attractions of participating as a developer.

- Accelerating partnering platforms: Collaboration and partnering have been defining features of the COVID-19 vaccine research response. Maintaining a state of readiness and bringing better visibility to the potential network of collaborators could allow development initiatives to start more quickly. This could be accomplished not only by matching academic institutions with commercial scaling partners but also by helping regional and national developers tap into the broader community. CROs, contract manufacturing organizations, testing providers and complementary technology providers (e.g., adjuvants) should be considered part of this collaboration ecosystem.

- Funding continuity: There needs to be clear continuity of funding available for proof of concept, early development and scale-up. Current funding vehicles have different remits requiring hand-offs throughout the development life cycle. This may be appropriate for routine research but not for accelerated pandemic research responses.

- Global trial infrastructure: A ready-made global network of distributed clinical trial centers is required for major epidemics to ensure that efficacy can be properly assessed in the context of different viral mutations and variations in case demographics.

- A research trust bank for the future: Much of the innovation and many of the preclinical candidates will not evolve into successful vaccines for COVID-19. However, many of them could be important accelerators and springboards for future coronaviruses and pandemics. We owe it to future developers to consolidate this rich substrate of innovation and make it as accessible as possible.

We are on the brink of a 12-month vaccine response, and the recommendations here could compress timelines further, perhaps to six or nine months, if everything is aligned from the start. In the context of COVID-19, this might have forestalled the spread to large parts of the world, including Brazil and India, and prevented the second wave of infections, saving hundreds of thousands of lives and restoring economic health within a few months after lockdowns were largely enforced.

Acknowledgments

The authors would like to thank Bruce Gellin at the Sabin Vaccine Institute and Ruth Katz at the Aspen Institute for initiating this study and active collaboration in shaping the work and analysis. We would also like to thank Kearney (https://www.kearney.com/health) for its generous support in providing resources for the study.

Finally, we would like to thank all the organizations that participated in our survey and interviews at such a critical time in their own response to COVID-19.

Anis Chagar is a management consultant in Kearney’s health care practice, leading engagements involving strategic data analytics and complex modeling to drive operational improvements. With international experience across North America, Europe and the Middle East, Chagar has broad experience with different health care delivery models and has recently worked on the design and operation of a new care delivery system for a major middle-income health system to improve coverage, efficiency and outcomes. Chagar is interested in how technology can play a role in improving access to health care, especially in remote areas. In Morocco, he helped to set up and operationalize a dispensary facility, while in San Francisco, he helped fast-growing startups tackle their most critical operational and strategic growth bottlenecks through the Kearney Venture Boost Camp initiative. Chagar holds a master’s degree in mechanical and industrial engineering from Arts & Metiers Paris and a master’s degree in operations research from the University of California, Berkeley.

Linda Zuo is a management consultant in Kearney’s health care practice. She advises large pharmaceutical companies and health care provider groups on the topics of supply chain management, contract manufacturing, clinical operations and digital transformation. Zuo is currently also leading a team at Kearney to help social innovation startups tackle various challenges, including digitization strategy, reflecting the impact of COVID-19 on care delivery models. Prior to joining Kearney, she conducted public health research in Rakai, Uganda, on the topics of HIV and infant malnutrition. In an earlier capacity as a member of Systems Utilization Research for Stanford Medicine, she worked with Lucile Packard Children’s Hospital Stanford to develop a screening system for child maltreatment. Zuo holds a master’s degree in health system modeling from Stanford University.

Michael Thomas is a partner at Kearney’s health care practice, with more than 20 years consulting experience in the health care sector. He leads the firm’s advisory services in the area of health policy, working on behalf of both governments and the health systems and lifesciences industry on topics related to innovation and innovation diffusion, patient access and medicines coverage, and value in health care. Thomas has worked extensively with systems in highly developed economies, as well as in large middle-income markets, including Russia, China and Saudi Arabia, and in lower-income markets. Prior to joining Kearney, he worked for the health care consulting teams at PricewaterhouseCoopers and IBM and held roles in strategy and business development with SmithKline Beecham (now GSK). Thomas holds a master’s degree from Cambridge University, England in history and social political sciences.

Michael Watson is chief executive officer of VaxEquity and a UK-trained physician with more than 20 years of global vaccines R&D and vaccination policy leadership and implementation experience, based in the UK, France, and the US. He has led teams and vaccine development projects for global vaccine companies as well as for cutting-edge biotech companies, most recently as president of Valera, the infectious diseases and vaccines venture of the mRNA vaccine company Moderna. As well as taking eight vaccines to first in humans, three to phase 2/3, and three to licensure, recommendation, and launch, Watson has extensive experience with novel platforms and technologies, global vaccines (Gardasil/HPV, polio, and influenza) and national and global vaccination innovation (Pediacel, Dengvaxia, polio and influenza). Watson is currently launching a vaccine start-up and working with a range of vaccine start-ups and COVID-19 vaccine developers.

References

Biomedical Advanced Research and Development Authority. (2020a, June 5). BARDA engages Moderna to expand domestic manufacturing of the Moderna SARS-CoV-2 vaccine (mRNA-1273) to protect against COVID-19 [Press release]. https://www.medicalcountermeasures.gov/newsroom/2020/moderna-vaccine/

Biomedical Advanced Research and Development Authority. (2020b). COVID-19 Medical Countermeasure Portfolio. U.S. Department of Health and Human Services. https://www.medicalcountermeasures.gov/app/barda/coronavirus/COVID19.aspx?filter=vaccine

Biotechnology Innovation Organization. (2020). COVID-19 Therapeutic Development Tracker. Retrieved September 8, 2020, from https://www.bio.org/policy/human-health/vaccines-biodefense/coronavirus/pipeline-tracker

Cohen, J. (2020, June 4). Top U.S. scientists left out of White House selection of COVID-19 vaccine short list. Science. https://www.sciencemag.org/news/2020/06/top-us-scientists-left-out-white-house-selection-covid-19-vaccine-shortlist

The COVID-19 Health Funding Tracker. (2020). The Economist. Retrieved September 8, 2020, from https://covidfunding.eiu.com/

Gavi. (n.d.). COVAX facility. Retrieved September 8, 2020, from https://www.gavi.org/covax-facility

Kearney analysis with data from WHO and Milken Institute trackers (2020, July 24). WHO tracker: https://www.who.int/publications/m/item/draft-landscape-of-covid-19-candidate-vaccines. Milken Institute tracker: https://www.covid-19vaccinetracker.org/

Van Riel, D., & de Wit, E. (2020, July 23). Next-generation vaccine platforms for COVID-19. Nature. https://www.nature.com/articles/s41563-020-0746-0

World Health Organization. (2020, October 19). Draft landscape of COVID-19 candidate vaccines. https://www.who.int/publications/m/item/draft-landscape-of-covid-19-candidate-vaccines

Finally and importantly, the trusted relationship with the public is finely balanced, and the combination of a growing anti-vaccination movement, the association of speed with risk, and the potential for inequity in how an eventual vaccine is distributed and priced could, if not carefully managed, ultimately work against the global vaccine agenda.