Understanding the Vaccine Ecosystem: Structure and Challenges

Introduction

Vaccines are recognized as one of the most cost-effective public health interventions available, yet the global vaccine ecosystem is not structured to fully realize their potential to improve health. Systemic constraints are preventing or slowing the development of a large number of scientifically possible candidates.

This paper describes the existing vaccine ecosystem; the influences on the decision making processes of developers; the challenges that arise between a vaccine candidate’s transition into Phase 2 clinical development and first country introductions; and their impact on cost, development time and public health benefits. The background and analysis here provide content to inform solutions that can break down systemic barriers limiting the availability of vaccines.

Characterizing the Vaccine Ecosystem

To gain insight into ecosystem dynamics, the research that supports this paper identified 61 vaccines that had reached at least Phase 2 clinical development from 2009 to 2019 and then narrowed the analysis to 33 vaccines, primarily for emerging infectious diseases with epidemic potential, diseases relevant to the risk of antimicrobial resistance and neglected diseases (see Table 1). (Each of those vaccines can be considered proxies for other diseases and vaccine candidates with similar characteristics.)

Diseases and candidate vaccines used in this analysis1The analysis did not include these diseases/vaccines: anthrax, candidiasis, Crimean-Congo hemorrhagic fever, cytomegalovirus, enterovirus A71, Epstein-Barr virus, Haemophilus influenzae type b (Hib), hantaviruses, hepatitis A/B/C, hepatitis E, herpes simplex type 2, human immunodeficiency (HIV), human metapneumovirus (hMPV), Lyme borreliosis, non-typeable Haemophilus influenzae, norovirus, pandemic influenza, polio, respiratory syncytial virus (RSV), Ross River virus, seasonal influenza, smallpox, syphilis, tick-borne encephalitis, tularemia, varicella, Venezuelan equine encephalitis, West Nile Virus, Western equine encephalitis, yellow fever or zoster.

Included diseases/vaccines

• Chikungunya

• Cholera

• Clostridium difficile

• Dengue

• Ebola

• Enterotoxigenic Escherichia coli (E. coli) (ETEC)

• Group A streptococcus (Group A strep)

• Group B streptococcus (Group B strep)

• Hookworm

• Human papillomavirus (HPV)

• Japanese encephalitis (JE)

• Lassa fever

• Leishmaniasis

• Malaria

• Measles

• Meningococcal meningitis

(monovalent C and multivalent)

• Middle East Respiratory Syndrome (MERS)

• Nipah

• Nontyphoidal Salmonella

• Plague

• Pseudomonas aeruginosa

• Rabies

• Rift Valley fever

• Rotavirus

• Salmonella paratyphi

• Salmonella typhi (typhoid)

• Schistosomiasis

• Shigella

• Staphylococcus aureus (S. aureus)

• Streptococcus. pneumoniae (S. pneumoniae)

• Tuberculosis (TB)

• Whole-cell pertussis

• Zika

Source: MMGH Consulting for the Wellcome Trust, 2020

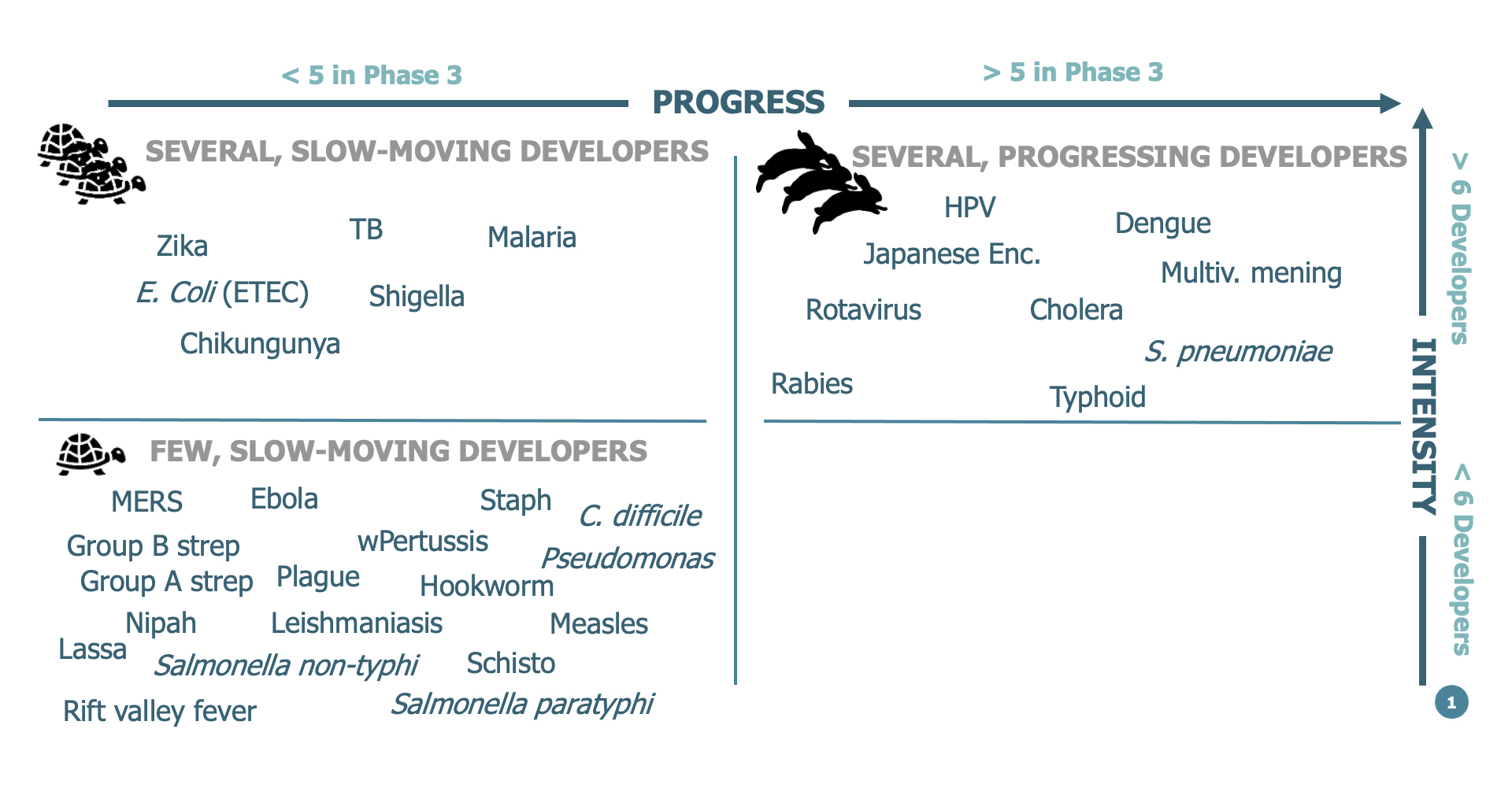

Most vaccines that target neglected diseases and diseases related to antimicrobial resistance are characterized by the presence of few developers and a small number of late-stage clinical trials. Exceptions, primarily relating to TB and malaria, cluster in an intermediate space, where several developers are engaged but there is slow progress into late-stage clinical development (see Figure 1). By contrast, second-generation vaccines that enhance an existing product (e.g., vaccines with more serotypes, combination vaccines) are characterized by a higher number of developers and late-stage clinical trials. Vaccines for emerging infectious diseases with epidemic potential enjoyed slightly more attention because of their global reach. In this space, the impact of the Coalition for Epidemic Preparedness Innovations (CEPI) is still too hard to assess since it was only launched in 2017 and its candidate vaccines were not yet sufficiently advanced during the 2009-2019 time frame of this analysis.

Figure 1. Status of development for vaccines included in this analysis

Source: MMGH Consulting for the Wellcome Trust, 2020

In general, technical and regulatory challenges; marketing and financial realities; and insufficient interest from policymakers, funders and developers limit the existence and pace of many vaccine development programs and discourage innovation.

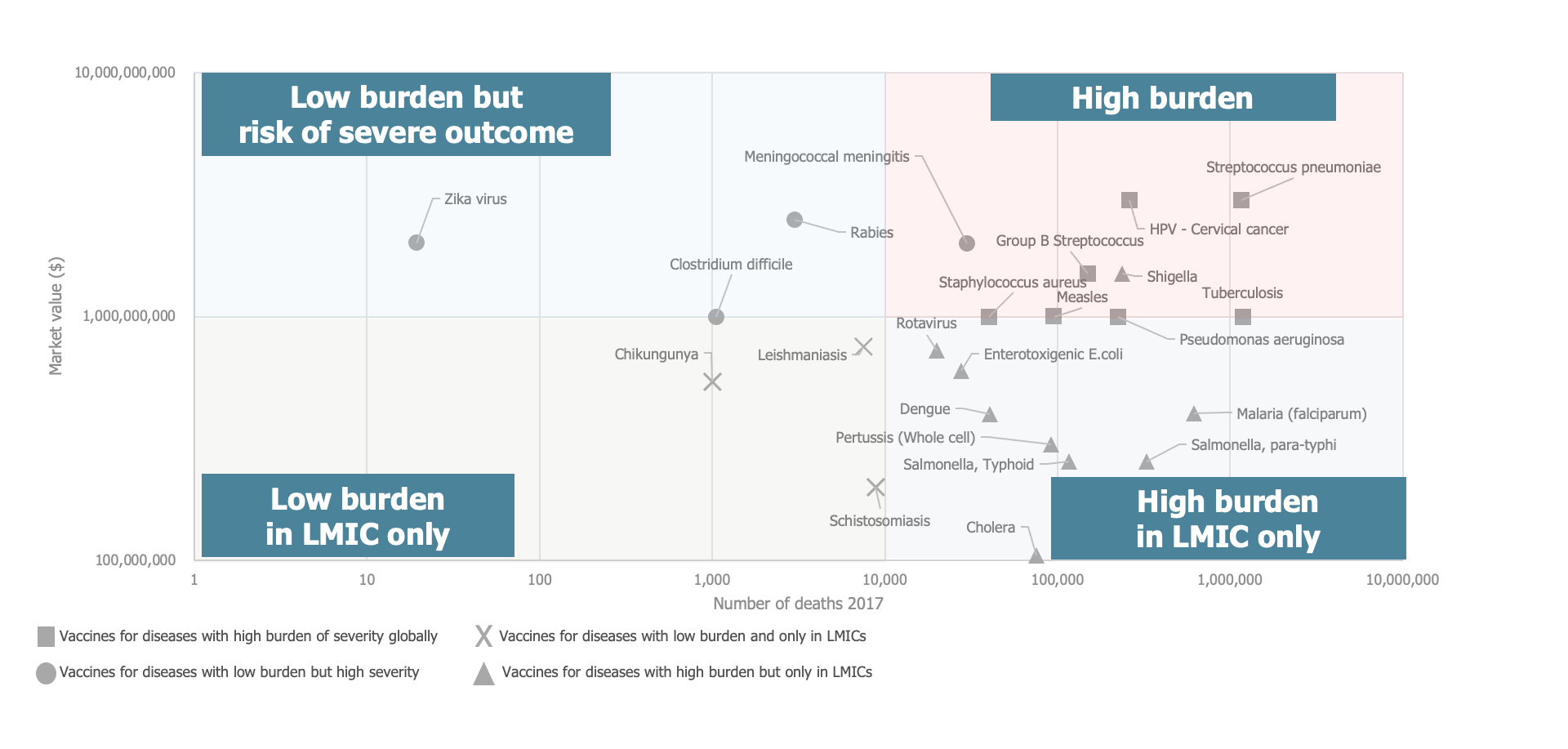

Overall, the level of engagement by vaccine developers is mostly associated with the projected size of the financial opportunity, with more engagement where the global burden or risk of severe disease is higher, and the risk of development, with more engagement where existing technology and established knowledge reduce the risk.

Twenty-four of the examined diseases and associated vaccines have estimated market values above $100 million per year, and these revealed a weak correlation (r = 0.31) between market value and the number of developers, indicating that developers have a moderate preference for markets with a higher value.

Research also showed a higher market value for vaccines against diseases that carry a high global burden of deaths compared to diseases where the burden, even if large, is concentrated in low- and middle-income country settings. Low-burden diseases that carry the risk of severe outcomes globally tend to have high market value, similar to high-burden diseases (see Figure 2).

Figure 2. Clustering vaccines by burden of disease and income level

Source: MMGH Consulting for the Wellcome Trust, 2020

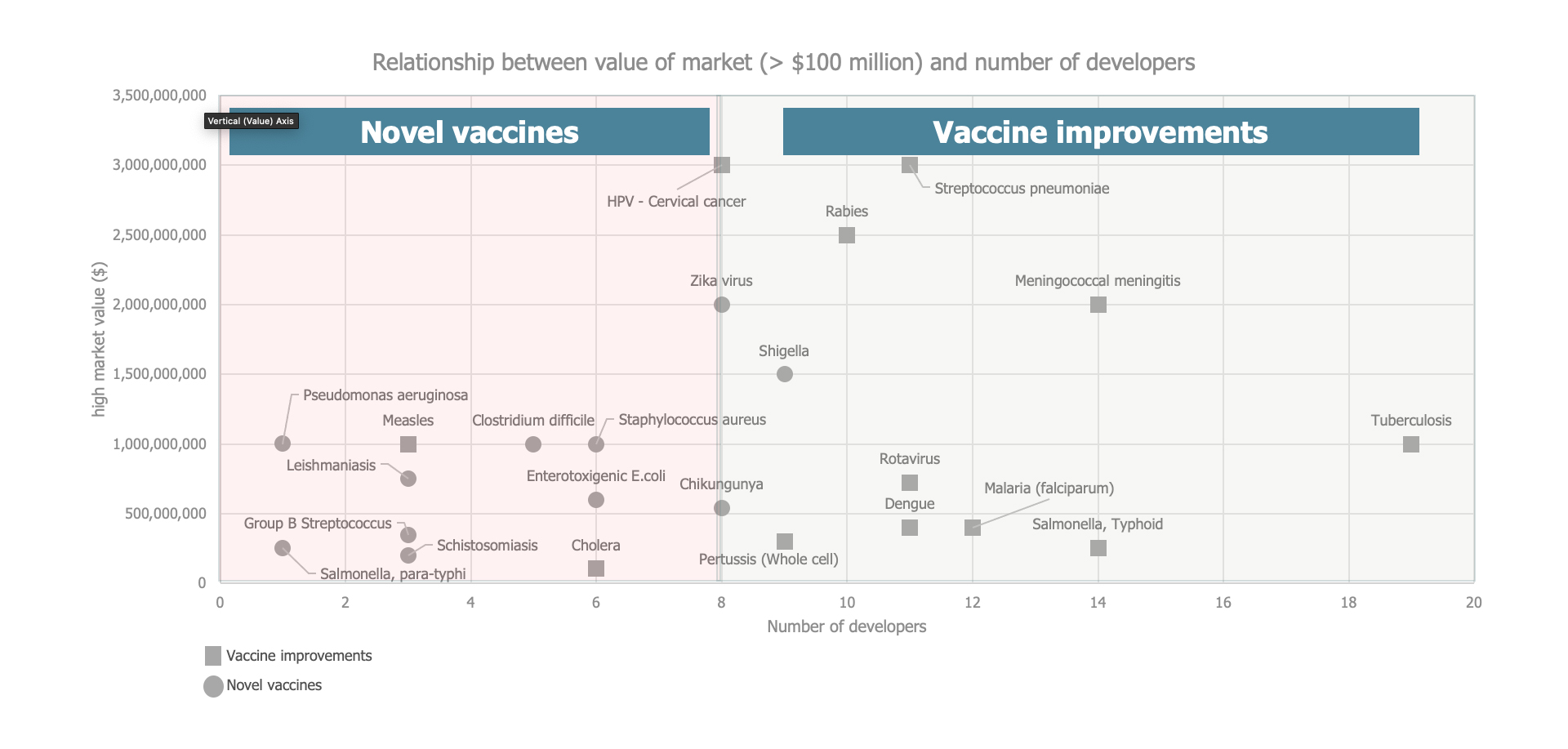

Given that most of the vaccines studied here have relatively low market values, the level of development risk — as defined by their use of technology that has already been proven and approved by a regulator and by the existence of an established market — emerged as a critical influencing factor. Low development risk attracted more developers, regardless of market value (see Figure 3).

Figure 3. Clustering vaccines by degree of development risk

Source: MMGH Consulting for the Wellcome Trust, 2020

Influences on Decision Making

The decisions that vaccine developers make about continuing, delaying or stopping development are influenced by many internal and external events and by factors that change over time and have varying degrees of influence, depending on the type of developer involved (e.g., an academic institution or a multinational company with a portfolio of licensed vaccines).

Internally, clinical trial results are the most likely trigger for a developer to review a decision to proceed on a vaccine. Scheduled reviews, such as comprehensive scientific- or business-focused project and portfolio reviews, are also relevant, particularly for large manufacturers.

On a more ad hoc basis, corporate events, such as leadership changes or the selection of research, manufacturing and financing partners, can influence decisions. So, too, can business opportunities, such as the acquisition of a product under development, a merger with another developer or a technology transfer. As well, unplanned events during a clinical trial, such as significant recruitment delays, may require immediate intervention and development decisions.

Externally, push events that stem from shifts in the environment or pull events intended to influence vaccine development are also important decision triggers. Disease outbreaks are especially impactful, as are emerging safety concerns, supply shortages and other specific events, especially those that generate pressure from stakeholders or the media. New financing opportunities, mergers and acquisitions, changes in competition or regulatory policy and scientific advances can also push vaccine developers to reconsider their decisions.

Pull factors include the availability of new financial incentives, such as advance market commitments or priority review vouchers, a recommendation for vaccine use by the World Health Organization (WHO) or priority status in the Gavi Vaccine Investment Strategy.

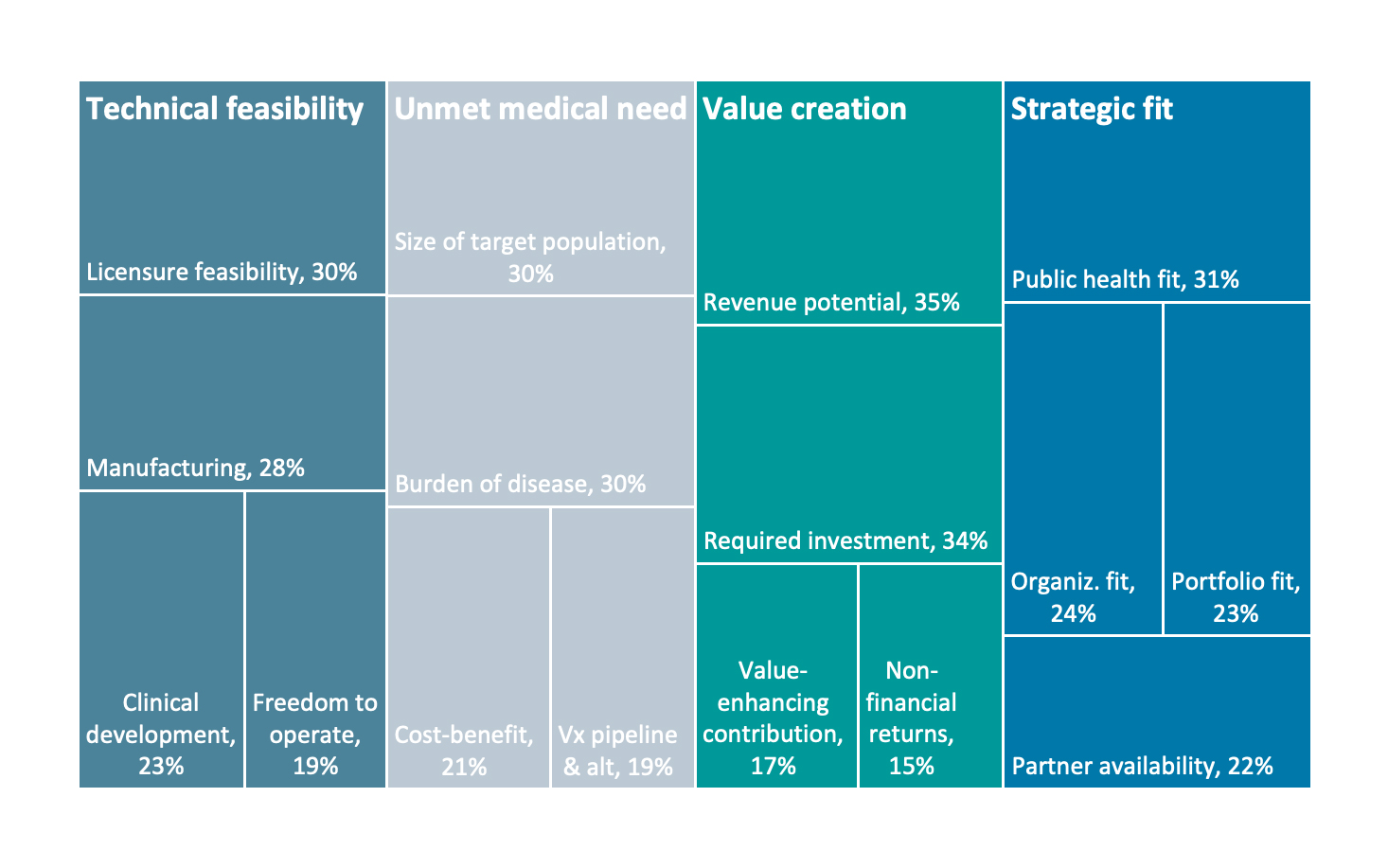

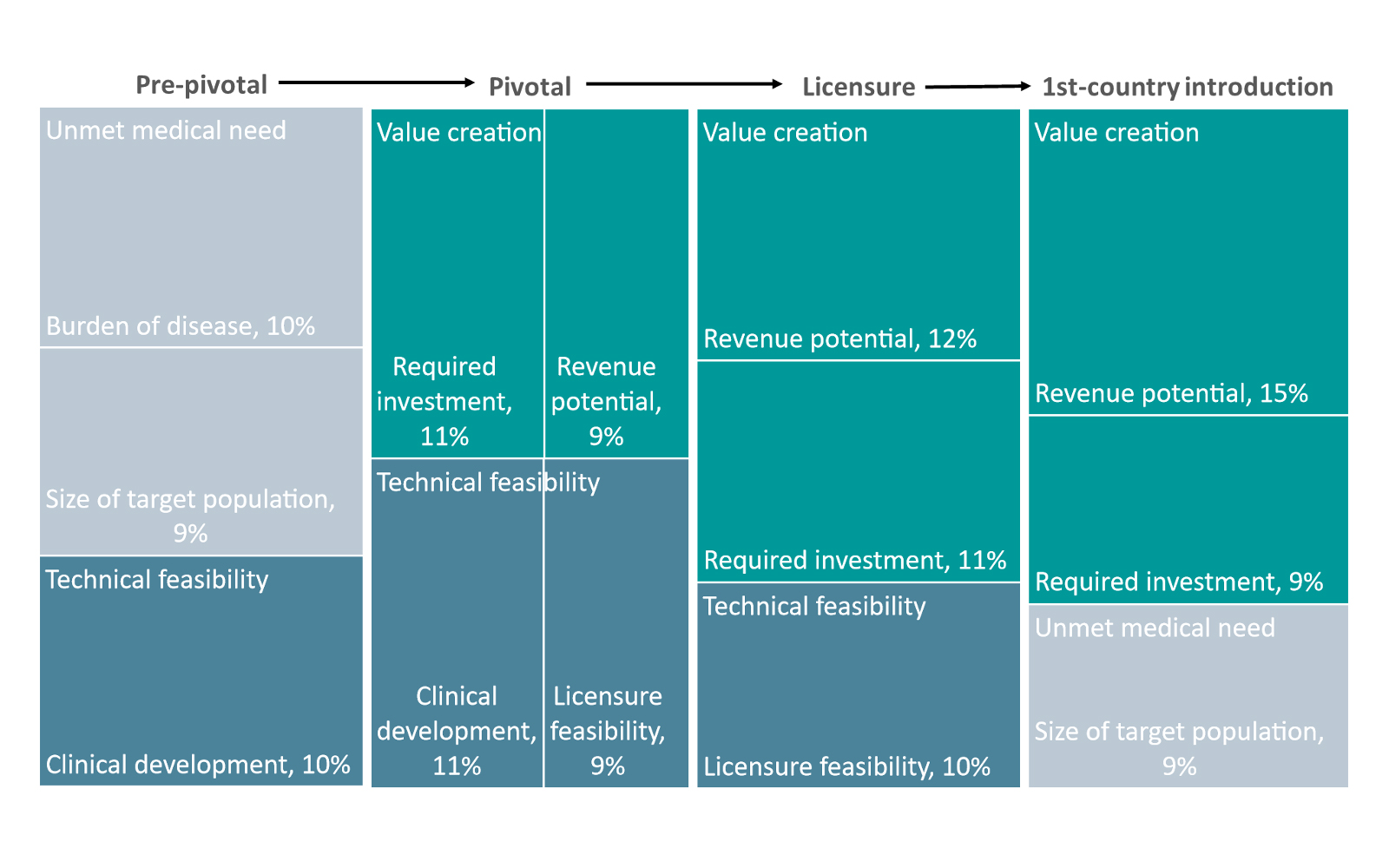

A survey-based analysis of what drives the decision to move to the next phase of vaccine development uncovered four broad areas of influence: (1) technical feasibility, (2) unmet medical need, (3) value creation and (4) strategic fit, with a set of sub-factors under each category (see Figure 4).

Figure 4. Relative importance of sub-factors within broad categories of influence

Source: MMGH Consulting for the Wellcome Trust, 2020

Technical Feasibility

The technical feasibility of vaccine development is most influenced by:

- Licensure feasibility: The requirements of the reference regulatory authority are the most important, followed by the selection and sequencing of countries where the vaccine will be licensed in its first years.

- Manufacturing process characteristics: Almost all manufacturing-related factors have significant influence on progress. Scalability is most critical, followed by quality control requirements. The complexity of the manufacturing, the reflecting technology, the required size of the manufacturing facility and the vaccine design are also germane.

- Clinical development feasibility: The probability of success has the most influence on decision making, followed by the emerging safety profile, as assessed from clinical trials. The expected size and difficulty of the pivotal trial(s) — a consequence of the disease epidemiology, the target countries, the design of the clinical trials and the position of the reference regulatory authority — are also key.

- Freedom to operate: Access to all required intellectual property, whether through ownership or licensing arrangements, is important, especially in the early phases of vaccine development.

Unmet Medical Need

The factors related to unmet medical need most likely to influence vaccine development decisions are:

- Size of the target population: The size of the target population, as defined by epidemiological parameters, is a measure of the magnitude of the problem and a key reference point for vaccine development decisions.

- Burden of disease: Mortality and morbidity emerge as the most relevant influences here. Periodicity and frequency of a disease are also relevant, while disability-adjusted life years and probability of outbreak occurrence are least important.

- Cost-benefit equation: The perceived importance of the disease to policy makers — not the actual calculation of a cost-benefit ratio — is the most important factor because policy makers generally make decisions based on input that goes beyond a quantitative assessment. Strong evidence of cost-effectiveness is also an important influence.

- Vaccine pipeline and alternative treatments: The existence of a rich pipeline for vaccines, a proxy for the degree to which medical need is truly unmet and a measure of the perceived level of direct competition, is key. The availability of other preventive and therapeutic interventions is also relevant, although to a lesser degree.

Value Creation Potential

Elements of value creation that influence vaccine development decisions include:

- Revenue potential: Through the lens of revenue potential, time to licensure emerges as the most influential factor in moving forward with vaccine development, followed closely by the likelihood that a vaccine will be recommended for global use and by the willingness and ability for costs to be covered at the country level.

- Required investment: The magnitude of the investments required for clinical development and manufacturing setup are the most influential decision making factors.

- Value-enhancing contribution: The availability of internal funds is a key influence, as is access to grant funding, which reduces the financial obligation on developers.

- Nonfinancial returns: Societal and reputational impact both have significant influence on decision making, depending on the position and strategy of a particular company.

Strategic Fit

Strategic fit, both within the developer organization and the broader public health context, influences decisions:

- Public health fit: Strong support from key global health stakeholders and a clear WHO position have substantial impact. The presence of strong, disease-specific opinion leaders and advocates to support clinical trials and influence policy decisions is also important.

- Organizational fit: A strong internal champion and the alignment of a vaccine with the priorities of important stakeholder groups on the developer’s board are also important influences.

- Portfolio fit: The availability of a vaccine “platform” — in which more than one vaccine uses similar technical approaches or targets similar customers synergistically — can influence vaccine development decisions.

- Partner availability: The availability of a partner interested in sharing the financial burden of development plays a key role, especially among companies that have no licensed vaccines. The latter group also ranks the importance of technology and manufacturing partners higher than those that already have vaccines on the market.

Influences on Decision Making by Phase of Development

While the focus of this analysis is on the factors that influence vaccine development after Phase 2, many decisions are made much earlier, especially when there is an overriding public health need or motivation to advance development quickly. SARS-CoV-2, of course, is the paramount example at the moment. In such circumstances, decisions can be compressed to take place in parallel, diverging significantly from the typical process.

The result is that the relative importance of the factors that influence decision making is likely to shift. Although certain external and technical factors (such as establishing a minimum safety profile) must still progress in a structured pattern, others, such as the potential to create value, may be considered somewhat differently. In this evolving environment, the standard sequence of vaccine development is less strictly delineated. Figure 5 presents the relative importance of decision making influences in the context of an evolving vaccine life cycle that moves more swiftly from early research through commercialization.

In the pre-pivotal phase, which includes the decisions made through Phase 2, unmet medical need and technical feasibility are the most important factors. Technical feasibility continues to be an influential factor in the subsequent pivotal trial phase, covering the decisions beginning with the transition into Phase 3 and continuing through that phase. Within the category of technical feasibility, the feasibility of clinical development and licensure emerge as the most significant sub-factors.

As development programs progress toward commercial development, creating value assumes the greatest influence on the decisions of vaccine developers. The revenue potential and total required investment are key factors as licensure is pursued. In the first country introduction of a licensed vaccine, the dominant influence is value creation, which is typically a function of the target population that has been identified and the policy recommendations that have been made, or are under discussion, at the global, regional and country levels.

Figure 5. Leading decision making influences within each phase of development

Note: These are the most important influences, but there are many others, explaining why the percentages do not add up to 100%.

Source: MMGH Consulting for the Wellcome Trust, 2020

Influences on Decision Making by Types of Developer

Decisions about which vaccines to pursue, and the range of possible outcomes, are also significantly influenced by the type of organization involved:

- Large, established manufacturers are driven by technical feasibility concerns and can readily stop development of an individual vaccine because they are less dependent on a single product. Because large organizations may have alternative ways to generate a larger or faster return on investment, strategic fit and opportunity cost are major influences. Value creation, driven by the need to contribute to overall financial performance, also plays a leading role in decision making.

- Midsize private companies with fewer resources are especially concerned about technical feasibility and will likely give special consideration to the portfolio fit of new vaccines. Value potential is essential given their need to focus on vaccines with a favorable business outlook.

- Midsize national developers that are either owned by the government or closely aligned with one typically focus only on vaccines of national and regional relevance, emphasizing unmet medical need. The strategic fit with national needs is often the overriding decision making factor.

- Midsize and small biotech organizations, which typically have no licensed vaccines, are often willing to take greater risks in terms of technical feasibility and may tenaciously pursue development, adjusting their plans rather than stopping altogether. The potential to create value, whether through continued development or exiting via licensing or acquisition, is a driving force, and unlike large vaccine developers, these smaller organizations may pursue value prior to licensure.

- Academic and government-associated developers are influenced by unmet medical need and research that has a strategic fit with their agendas and priorities. These developers are often entirely dependent on external funding to progress to the point at which they can sell vaccine rights, and their decisions may depend exclusively on continued funding.

- Product development partnerships tend to focus on specific disease targets or a well-defined mission, much like academic and government developers, but their smaller portfolios make them highly influenced by unmet medical need and strategic fit. The degree to which partnerships have the independence to make decisions with financial implications is dictated by the relationship of each partnership with its funders — some funders may view their influence as primarily technical, while others might incorporate cost-benefit factors.

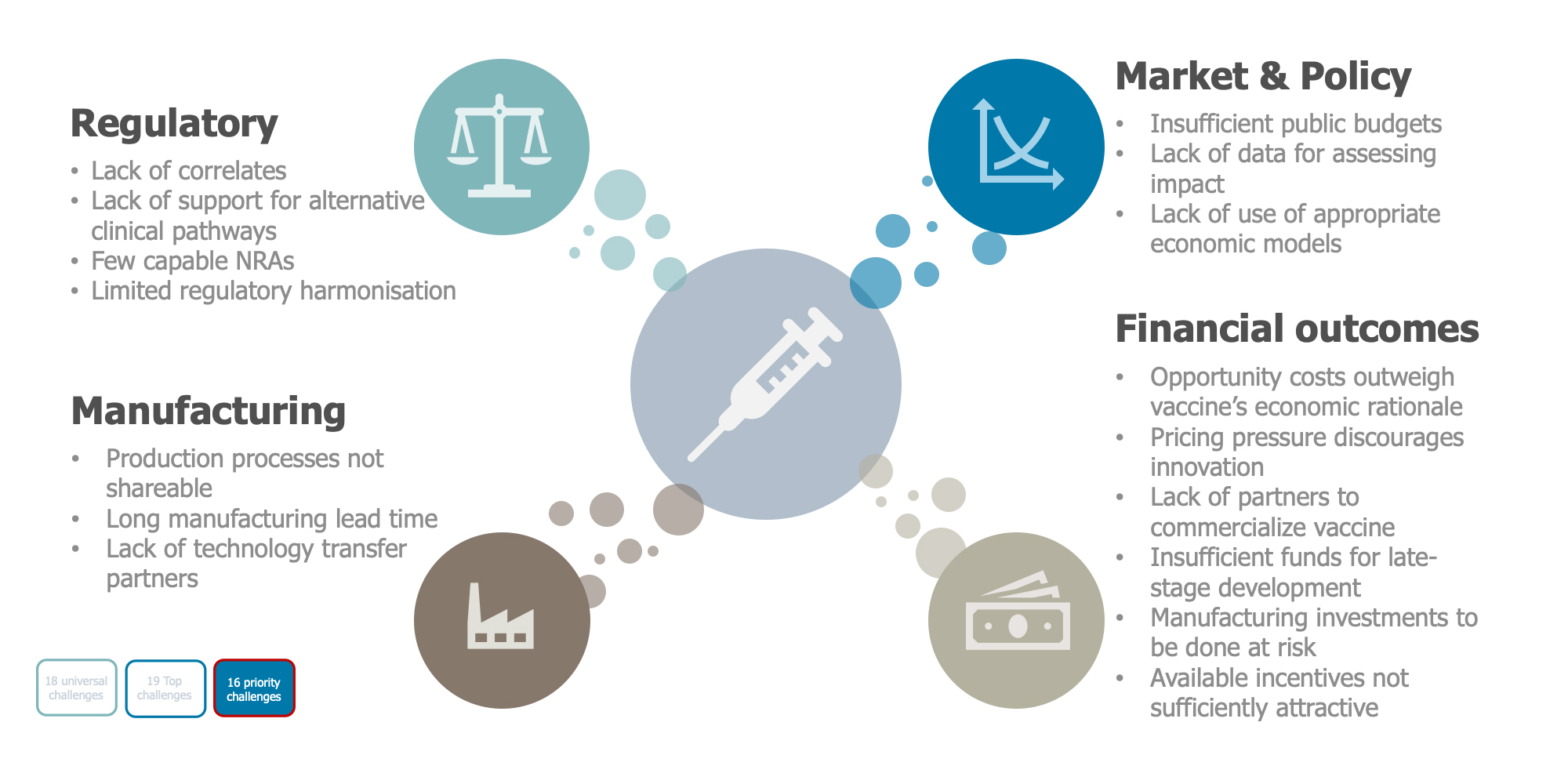

Priority Challenges

A multitude of challenges cause developers to stop progressing vaccine candidates from Phase 2 clinical testing through licensure and to first country introductions. A literature review and subsequent analysis identified 54 such challenges, which can extend the duration of development, elevate the risk that a developer will not pursue licensing and increase the price of vaccines if they do become available.

Typically, many of the fundamental scientific and technical questions have been addressed by the time of the Phase 2 transition, and the focus of activity has turned toward market economics and the relative uncertainty of demand. From the standpoint of the vaccine developer, decisions to proceed are particularly influenced by the estimated time and cost necessary to proceed and by the strategic fit of vaccine candidates within its portfolio. Based on these factors, the list of priority challenges was narrowed to 16, sorted into four broad categories — (1) regulatory, (2) manufacturing, (3) market and policy and (4) financial outcome (see Figure 6).

Figure 6. Sixteen priority challenges

Source: MMGH Consulting for the Wellcome Trust, 2020

Regulatory Challenges

With the transition into Phase 2 clinical development, the focus of regulatory activities turns toward proving the efficacy and safety of a vaccine. In general, an absence of clear regulatory standards and established pathways to licensure, coupled with the limited expertise of most national regulatory authorities (NRAs) and the absence of a global cooperative regulatory strategy, are significant impediments. Among the challenges:

- Lack of recognized surrogates or correlates of efficacy: The ability to assess the efficacy of a vaccine by measuring a particular immune response, rather than clinical outcomes, greatly facilitates vaccine development, licensure and subsequent effectiveness monitoring. Absent recognized surrogates or correlates of efficacy, trials must be powered to show protection against disease, which means larger and more costly trials and higher per-dose prices.

- Lack of support from regulators for alternative clinical pathways: Studies of human infection are useful for proof of concept, pathogenesis, down-selection, immunogenicity and efficacy studies. Likewise, adaptive clinical trial design with a single control group, step-wedge design and other features can speed up development and allow multiple vaccines to be assessed in parallel (as seen with Ebola and SARS-CoV-2 trials). However, many regulators are reluctant to accept these nonconventional clinical pathways as pivotal trials, preferring that vaccines demonstrate effectiveness against naturally acquired disease in a traditional fashion. This extends the lead time before vaccines become available and generates higher prices once they are.

- Too few national regulatory authorities capable of regulating the primary licensure of a novel vaccine efficiently and flexibly: Regulatory capability for novel vaccines is highly concentrated among a small group of government regulators. Although the WHO has sought to expand regulatory capability, evaluate the performance of regulatory authorities and — where possible — confer WHO Listed Authority (WLA) status, there is still a paucity of knowledgeable regulators capable of developing the sophisticated approach needed to guide developers. The relative dearth of authorities able to license innovative vaccines efficiently means that developers must choose between a sophisticated NRA in a country with lesser needs, thus delaying access elsewhere, or an NRA that lacks strong competencies, slowing the licensing process.

- Lack of harmonized requirements for quality, efficacy, labelling, packaging and the safety of biologicals and diagnostics across NRAs: Primary licensure of a vaccine with global demand is just the starting point — pursuing licensing in nearly 200 countries adds costs and delays to vaccine availability. The lack of international or regional standards forces developers to meet specific local requirements and possibly to conduct bespoke clinical trials, regardless of clinical or epidemiological needs. The need to establish different safety monitoring processes or meet unique labelling and packaging requirements, for example, adds costs and delays and can reduce access if developers decide not to license their products in certain jurisdictions.

Manufacturing Challenges

Efficient commercial-scale vaccine manufacturing is hampered both by a lack of experience in vaccine manufacturing and by the need to make early decisions about the manufacturing process and capacity in order to reduce input costs and generate a reasonable return on investment. Among the challenges:

- Lack of ability to share production processes or facilities for multiple vaccines: Because vaccines use many different production technologies (e.g., fermentation in yeast, growth in cell culture or eggs, lyophilization), facilities typically require unique equipment. Even when manufacturers of different vaccines can share equipment or space, an extensive changeover cleaning procedure is required for quality control, often rendering any benefits of a shared facility moot. The fewer the opportunities to share production processes, the greater the time and costs developers incur to establish unique manufacturing lines or facilities. This also raises the risk profile of those investments, reducing the likelihood of “go” decisions.

- Long lead time to establish and size manufacturing capacity: Decisions to build a dedicated manufacturing facility or production suite at scale and determination of the appropriate size needed to satisfy projected demand are typically made prior to Phase 3 clinical development. Building and validating a plant can take up to five years to complete and have little to no utility if the final clinical phase is not successful or if the demand is much smaller than expected. Yet waiting to invest in a manufacturing plant until some clinical success is demonstrated or until there is more clarity about demand increases development time because at least some Phase 3 clinical trial material must come from the manufacturing plant where the licensed vaccine will be produced.

- Lack of partners to receive technology transfer: Developers unable or unwilling to establish manufacturing capacity themselves face the difficult task of finding partners for both clinical and commercial material. Although many organizations are involved in early- to mid-stage vaccine development, far fewer are capable of manufacturing a licensed vaccine, especially one using more innovative technologies. The inability of smaller developers to identify potential partners can lead promising vaccine candidates to be abandoned.

Market and Policy Challenges

Market predictability and policy support are strongly related to the feasibility of recouping costs. But vaccine developers operate in a highly uncertain environment because demand is not usually characterized by incremental change but rather by large-step changes that result either from environmental factors (in the case of an outbreak) or national policy (in the case of a new vaccination program). Among the challenges:

- Insufficient public budgets to purchase and implement immunization programs: The general state of a country’s public finances, pressure on

health budgets and political considerations can all constrain governments’ ability or willingness to invest in immunization programs. Despite other influences — such as WHO vaccine recommendations, initiatives such as the Sabin Vaccine Institute Sustainable Immunization Financing Program (to assist in public budgeting) and advocacy efforts by developers and other stakeholders — country-level decisions ultimately dictate the scope of vaccination programs. The gap in the use of data-informed and evidence-based advocacy to sustain or increase budget allocations for vaccination programs poses considerable risk to vaccine developers. - Lack of data to assess the potential impact of vaccination in target populations and uncertain policy recommendations: In the absence of rigorous surveillance capabilities and sound epidemiological data, developers are challenged to demonstrate the true impact of vaccination. An uncertain policy environment — especially for vaccines that lack a clearly defined target population, initially target low-income countries, need new implementation strategies or may be affected by the performance of immunization programs — is a further challenge that translates directly into market uncertainty.

- Lack of appropriate models for economic valuation globally or in certain countries: Without a solid evidence base that demonstrates the burden of disease and the potential impact of vaccination, or a commonly accepted method for valuing the economic benefits of immunization, it is difficult to advocate for greater public spending on vaccination programs. Relying on cost-effectiveness assessments, rather than considering broader societal benefits, undervalues the contributions that vaccines can make to better societal outcomes. That, in turn, influences the decisions of policy makers and reduces the appeal of vaccines as research targets.

Financial Outcome Challenges

Generally high development costs and lower revenues for vaccines, coupled with the unpredictable market and funding streams that are ill-suited to the long development timelines and investment requirements of vaccines, all limit the number of developers to secure the necessary capital to proceed to first-country introduction. Among the challenges:

- Opportunity costs that outweigh the vaccine’s economic rationale: Resource allocation decisions dictate that limited resources be spent on projects with an acceptable return on investment, and generally on those with the highest return. Because of the need for large clinical trials, significant single-purpose manufacturing plant investments and a higher risk profile, vaccines are generally more expensive to develop than other therapeutic categories. Combined with the high degree of uncertainty about revenues, they are also less profitable than other classes of medical products (such as pharmaceuticals for oncology or chronic conditions).

- Pricing pressure that discourages innovation to improve existing vaccines: Buyers are often unwilling to pay a premium for presentation improvements, including for features that result in net savings (e.g., a per-dose price that is higher for a single dose than for a three-dose schedule). This limits developer interest in making improvements and reduces the number of developers and level of competition.

- Limited availability of aligned partners to commercialize vaccines: Vaccine developers that lack capacity or interest in pursuing licensure, typically public and academic institutions and smaller developers, must find available partners that can assume ownership of a vaccine, license it and directly or indirectly commercialize it. Globally, fewer than 100 companies commercialize vaccines, and many of them are small entities focused on their domestic markets that are not prepared to act as partners.

- Insufficient access to funds for late-stage development: Phase 3 is the most expensive part of vaccine development because of the high risk and long lag before the developer can recoup any return on investment. Very few small and midsize developers can fully self-fund this stage, which can cost anywhere from $30 million to $500 million, depending on the vaccine, the trial and the NRA requirements.Identifying and securing funding from the financial markets, as equity or debt, is challenging because investors typically pursue more immediate returns and lenders seek less risky ventures. This is especially true for companies in emerging markets, such as India, where financial markets are less sophisticated and less interested in risky enterprises.

- Need for expensive manufacturing investments prior to clinical success or demand certainty: Because it can take as long as five years to complete a manufacturing facility, construction begins well before

Phase 3 data are available or licensing has been achieved. Yet the overall probability that a vaccine candidate will fail in Phase 2 is 42 percent (Wong et al., 2019), meaning that production capacity decisions must be made when the risks are quite high. Few large developers can invest “at risk,” and others must seek outside support that is likely to be limited in size or to certain diseases.

licensing has been achieved. Yet the overall probability that a vaccine candidate will fail in Phase 2 is 42 percent (Wong et al., 2019), meaning that production capacity decisions must be made when the risks are quite high. Few large developers can invest “at risk,” and others must seek outside support that is likely to be limited in size or to certain diseases.

Available incentives (e.g., pull mechanisms) that are not sufficiently attractive for the developer: Lack of adequate funding and other incentives from governments and foundations deters the development of vaccines that are technically possible, leading developers to concentrate on markets that command higher prices. Private capital is often insufficient to fill the gap, particularly in countries where the financing market is not fully developed.

Conclusion

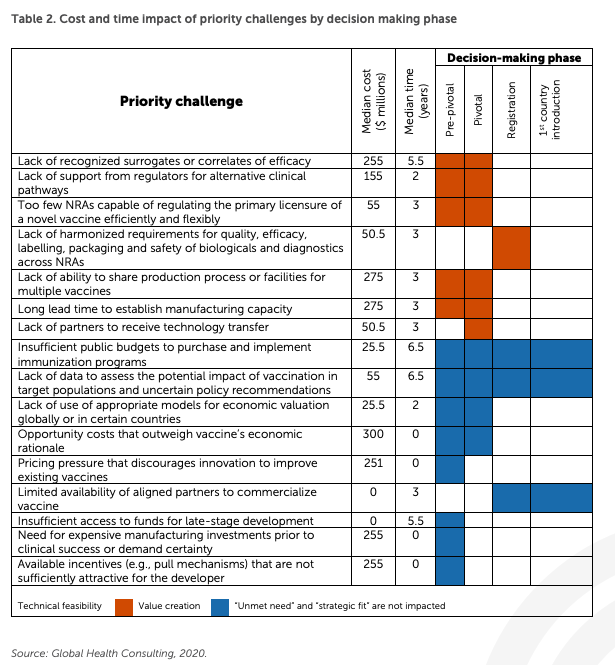

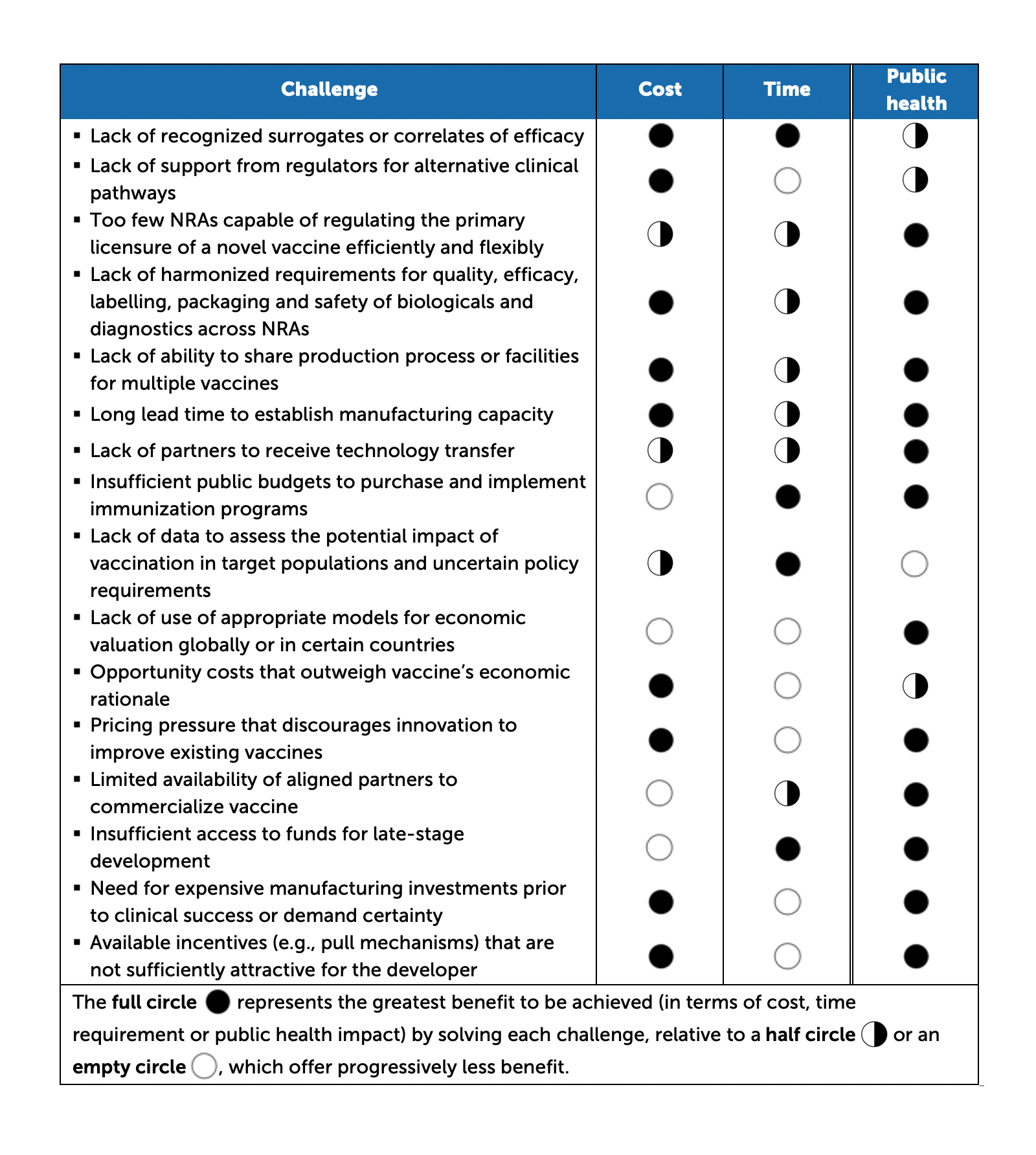

Some of the 16 priority challenges are universal; others have the most powerful influence on one or more of a specific category of vaccines. But all of them add either significant costs to the development process or generate significant delays, and often they do both (see Table 2).

Solving vaccine ecosystem challenges thus presents substantial opportunity for benefits in cost, time and public health (see Table 32For each disease relevant to each challenge, the public health impact was measured by adding the level of six indicators: global mortality, prioritization by major global health agencies, relevance for impoverished populations, contribution to antimicrobial resistance, level of investment from global donors and the degree to which a disease is top of mind in the general public and for key political decision makers. ).

Table 2. Cost and time impact of priority challenges by decision making phase

Source: MMGH Consulting for the Wellcome Trust, 2020

Table 3. Cost, time and public health benefits of resolving challenges

Source: MMGH Consulting for the Wellcome Trust, 2020

Current efforts to address impediments to vaccine development have generally been led by individual institutions, with little global coordination, too often resulting in discordant or duplicative efforts. A more successful approach would tackle the systemic constraints that prevent or delay the development of scientifically feasible vaccines beyond Phase 2 clinical development. An efficient, synergistic and equitable vaccine ecosystem can emerge by considering root causes, looking beyond products for individual diseases, transcending organizational boundaries and interests and questioning established norms.

The SARS-CoV-2 pandemic has instilled a sense of urgency in the pursuit of vaccines. Perhaps that can be leveraged to address the longstanding challenges that have hampered the vaccine ecosystem for decades.

Stefano Malvolti is managing director and co-founder of MMGH Consulting, an advisory agency assisting public and non-profit clients in design, implementation and evaluation of programs and products targeting vaccine-preventable and infectious diseases. He is also a board member of Fondazione Achile Sclavo, an NGO focused on facilitating vaccine development for neglected diseases. In 2016, he served as CEO at Univac, an early-stage biotech company developing a vaccine platform for viral diseases. Previously, he was the director of vaccine implementation at Gavi, the Vaccine Alliance, where he oversaw more than 150 country introductions across 11 vaccine programs. He has also held positions at Novartis Vaccines & Diagnostics, PATH, Novartis Pharma, and Baxter Healthcare in public policy, marketing, strategy and finance. Malvolti holds a master’s degree in public health from Johns Hopkins Bloomberg School of Public Health in Baltimore and a master’s degree in business economics from Bocconi University in Milan.

Karyn L. Feiden is a New York City-based writer and editor who has covered public health, health care and medicine for three decades. She works closely with the Aspen Institute’s Health, Medicine and Society Program on numerous initiatives, including Aspen Ideas: Health, the NeuroArts Blueprint, the Sabin-Aspen Vaccine Science & Policy Group, and a Blue Cross Blue Shield project on breakthrough drug pricing. She also provides communications services to the Robert Wood Johnson Foundation, including editorial work on five volumes of the Oxford University Press Sharing Knowledge series. Other clients have included Drexel University School of Public Health, American Red Cross and the U.S. Food and Drug Administration, as well as numerous public and not-for-profit organizations engaged in policy, philanthropy, research and practice.

References

MMGH Consulting. (2020). Effective Vaccine Ecosystem. Wellcome Trust Research Paper

Wong, C. H., Siah, K. W., & Lo, A. W. (2019). Estimation of clinical trial success rates and related parameters. Biostatistics, 20(2), 273–286. https://doi.org/10.1093/biostatistics/kxx069

An efficient, synergistic and equitable vaccine ecosystem can emerge by considering root causes, looking beyond products for individual diseases, transcending organizational boundaries and interests and questioning established norms.