Understanding Global Vaccine Economics and Research and Development

Introduction

Vaccines are among the most cost-effective ways to prevent morbidity and mortality from infectious diseases (Review on Antimicrobial Resistance, 2016) and have become the fundamental tool of the global public health community in the fight to improve health outcomes for the world’s population.

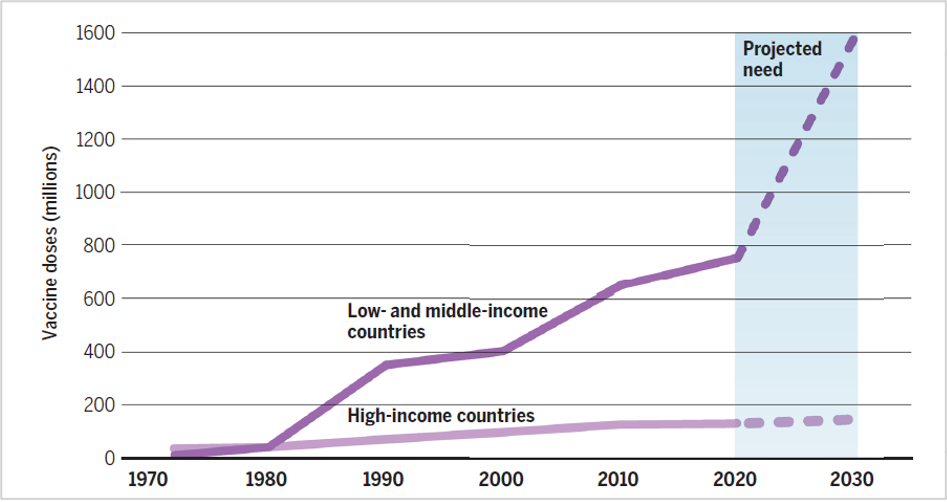

Figure 1: Delivery of vaccine doses over time worldwide

Source: Program on the Global Demography of Aging at Harvard University

The market for vaccines has grown considerably since the 1970s, primarily driven by the demand in low-income countries (LICs) and middle-income countries (MICs). Before COVID-19, the global vaccine market was expected to exceed $62 billion by 2027 (Top 10 vaccine manufacturers, 2020). Figure 1 shows the number of vaccine doses delivered globally from 1970 to the present, as well as the projected need from 2020 through 2030 (Rappuoli et al., 2019).

While it can be very profitable, the vaccine market is also extremely complex and interconnected, reflecting the difficulties of vaccine market research and development (R&D), the importance of intellectual property, and the intricacies of supply and demand that are created and influenced by vaccine market players. These vaccine market complexities have been further exacerbated in a world searching for a COVID-19 vaccine.

Understanding Vaccine R&D

Vaccine R&D can cover several broad areas:

Research: The development of a new drug begins with a search for new chemical compounds, often drawn from large databases of known compounds and published information. Major international pharmaceutical companies typically have thousands of such chemical compounds within their R&D “pipelines” at any given time, including a variety of therapeutics and vaccines. At this stage in the process, preclinical research involves testing promising compounds in vitro and on animals in order to evaluate toxicity and to assess therapeutic potential.

Development: After initial testing, manufacturers will generally patent a product and seek government permission to undertake human trials. The potential new drug compound then moves through various stages of clinical trials, which can often take several years. The clinical trial process includes several prelaunch phases with increasing numbers of healthy people, as well as postlaunch phases that are intended to strengthen the product’s competitive position by developing data supporting efficacy and safety on a large scale. This process also allows manufacturers to develop an understanding of the correct dosing, including the appropriate age groups and dosing schedule.

Manufacturing: The manufacturing process is an important element for vaccine manufacturers, as vaccines are typically characterized as “biologics.” Biologics are significantly more complex to manufacture than drugs (known as “small molecules”), as they are manufactured in living systems rather than through chemical synthesis. As a result, the manufacturing process for biologics must remain substantially the same over time, which requires extensive process control (Biotechnology Innovation Organization, n.d.).

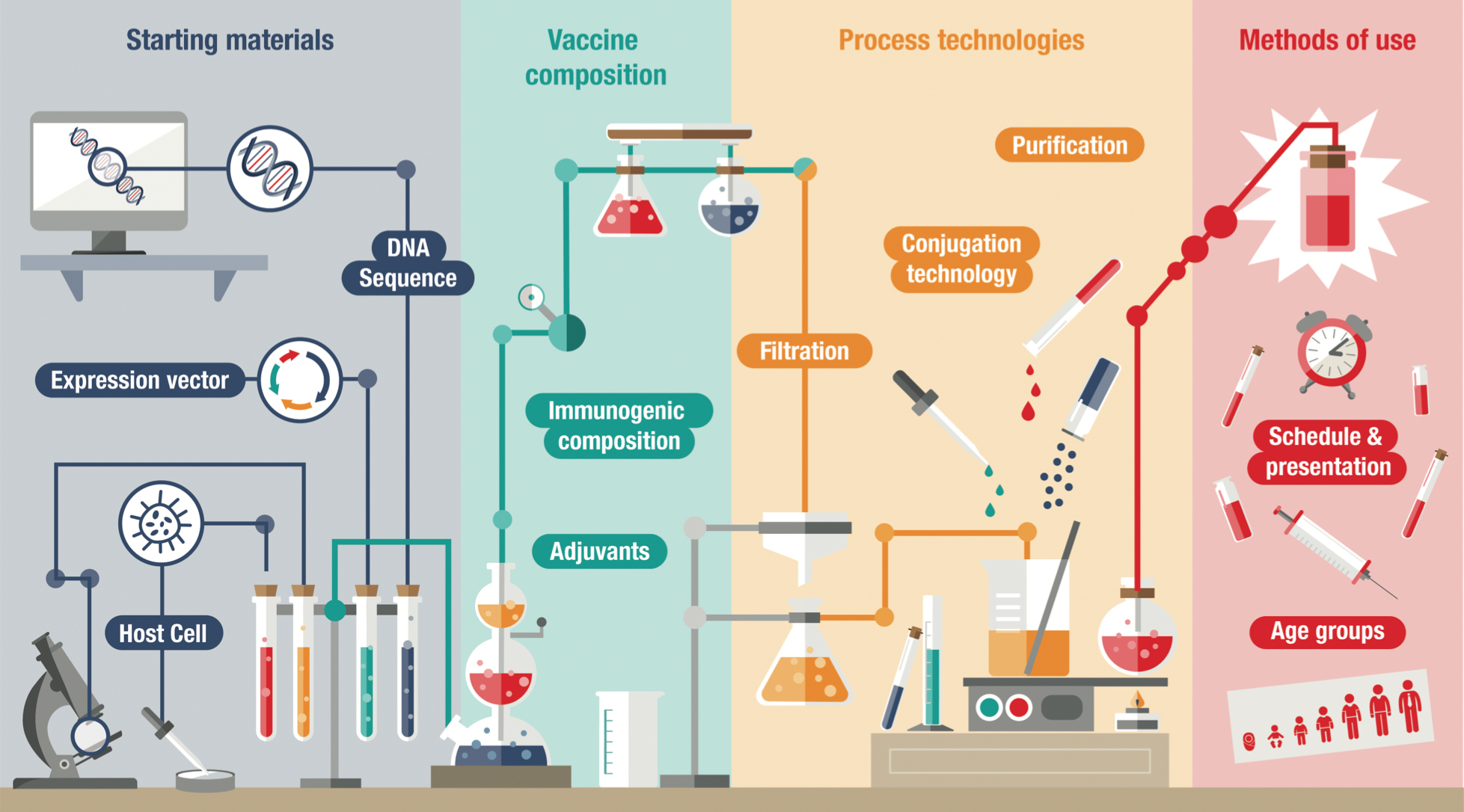

This means that vaccine manufacturers require regulatory approval not only for the compounds themselves but also for their overall manufacturing process (see Figure 2 for an overview of the vaccine development process). Any changes in production, such as new facilities, manufacturing equipment or raw materials, can trigger the need for new clinical trials to maintain licensure. Given the significant barriers to process improvement, vaccine manufacturers must have a high level of certainty about the manufacturing process early in the vaccine development life cycle (Plotkin et al., 2017).

A key feature of the global vaccine market is the significance of intellectual property. Unlike small molecule products, it is difficult to develop generic versions of biologics such as vaccines (called “biosimilars” or “bioequivalents”) because a new manufacturer must demonstrate equivalence not only in the composition of the vaccine but also in the manufacturing process. Often, the only way to establish whether any differences impact the safety and effectiveness of the biosimilar is to conduct new clinical trials (Biotechnology Innovation Organization, n.d.). This difficulty in replicating manufacturing processes, along with stringent intellectual property rights in developed countries, tends to limit competition in the vaccine market and create higher prices and supply vulnerabilities. While some mechanisms exist in the industry to enable information sharing, such as licensing arrangements and redesigning manufacturing processes, these efforts can be costly and time intensive (Médecins Sans Frontières, 2017).

In general, vaccine R&D is a difficult endeavor for manufacturers for two reasons:

- The chance of success is low. As of Q1 2020, the Massachusetts Institute of Technology estimates the probability that a vaccine will move from conception to Phase 3 trials is 39.8 percent (Project ALPHA, n.d.).

- The process is long. Pharmaceutical Research and Manufacturers of America estimates that in the United States, it can take more than 10 years to develop a novel vaccine, with only 12 percent of products that enter clinical trials ultimately approved for the market (America’s Biopharmaceutical Companies, 2020).

Combined, these two factors create a significant financial risk for vaccine development. As with most high-risk investments, the motivation is a high return on investment. The importance of reward becomes clear in this paper’s later discussion of the two distinct vaccine markets: developed markets and developing markets.

Aside from the obvious risk of dedicating resources that do not yield a viable vaccine, there are more subtle risks associated with vaccine R&D, including demand. The quest for an HIV vaccine is an enlightening example. Although the virus was identified in the 1980s and has claimed 33 million lives, there is still no HIV vaccine on the market (WHO, 2020e). One reason is the unique challenges associated with HIV, including the lack of natural immunity, the frequency of mutation, an indeterminate immune response and lack of animal models (The History of Vaccines, n.d.). An additional factor is that while some scientists have been working on vaccine options, others have made enormous progress in developing tools to prevent or treat HIV treatments, including life-saving antiretrovirals that limit the risk of transmission and pre-exposure prophylaxis (U.S. Department of Health and Human Services, 2020). While transmission has not stopped, these therapeutic advances have changed priorities. Even if a successful HIV vaccine reaches the market in the future, sales will likely be limited, giving vaccine manufacturers less incentive to continue investing resources here.

Understanding Supply: A Tale of Manufacturers

The vaccine market is characterized by significant barriers to entry, including high development and production costs, high failure rates, the need for high levels of competence and expertise, and lower revenues and profitability compared to the drug market. These barriers mean the number of manufacturers able to enter the vaccine market remains low.

The market for each vaccine has become so consolidated that many can now be described as monopolies or oligopolies; 32 percent of vaccines have fewer than four suppliers, and 63 percent have two or fewer suppliers that are prequalified by the WHO or UNICEF (WHO, 2018). This section explores in further detail the supply implications of these market failures.

The Economics of the Vaccine Market

Vaccine development and production are costly and capital intensive. Manufacturers require large-scale production and long product life cycles to produce at low cost, recover their sunk and fixed costs and earn a reasonable return on investment. Sunk costs in relation to R&D, facilities and equipment are incurred in the upfront investment stages of vaccine development and in preparing for production. Other direct and indirect costs, which can be fixed or variable in nature, are typically incurred once production has begun.

Historically, many vaccines were developed for a dual vaccine market (i.e., one targeting both developed and developing countries) (WHO, 2018). In that situation, the financial returns associated with high-income countries (HICs) have been sufficient to justify the commitment to vaccine development and provision of low-cost vaccines to LICs and MICs. Vaccine manufacturers made most of their profits in HICs, recouping their investment and production costs, and could sell the same vaccines at lower prices to countries with fewer resources. This model, however, has recently become more complicated as vaccine manufacturers engage in developing vaccines that lack a dual market. For example, vaccines against the Ebola and Zika viruses and for endemic diseases that are present predominantly in LICs and MICs, such as malaria and tuberculosis, lack the financing mechanism for dual-market vaccines. As such, vaccine manufacturers are looking for new ways to recoup their investments.

When planning production to supply multiple markets, manufacturers must also consider the competitive landscape and what market share is realistic and sustainable, as well as whether they will be able to compete based on their costs. They are unlikely to invest in new vaccines if they cannot foresee the opportunity to recoup their research, development and production costs, as even a company with a strong social commitment must answer to its shareholders. Indeed, in January 2018, three of the five major vaccine manufacturers announced that the world should not count on them to develop vaccines with no return on investment (Rappuoli et al., 2019).

Market Size and Constraints

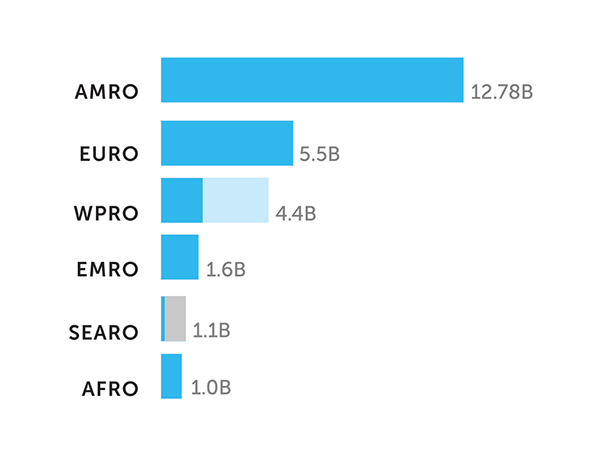

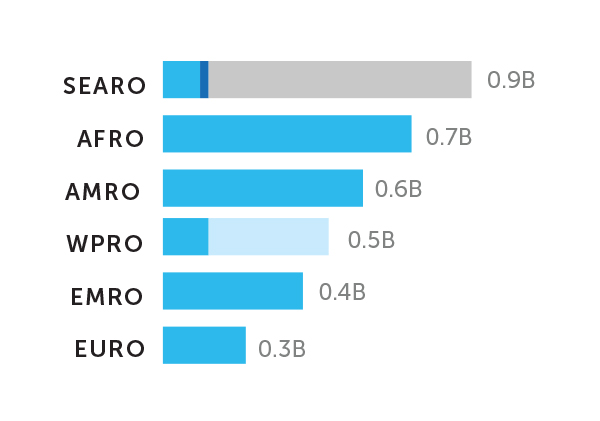

The WHO estimated that the global vaccine market was worth approximately $26 billion in 2018, a 25 percent increase from the prior year. Nearly 70 percent of this value (defined as revenue in dollar terms) was generated in the Americas and the European region, with countries in the Western Pacific, Eastern Mediterranean, Southeast Asian and African regions accounting for the remaining 30 percent of the market (see Figure 3) (WHO, 2019b). But dollar values paint an incomplete picture of the global vaccine markets. Exploring the disparities between developed and developing countries more clearly highlights the imperfections in the vaccine market and provides insight into the motivations of vaccine manufacturers serving countries at different income levels.

- HICs constitute 82 percent of the global vaccine market in terms of dollar value, but only about 20 percent of the annual volume of vaccines consumed (i.e., vaccine demand).

- LICs and MICs together account for about 18 percent of the dollar value of the global vaccine market but approximately 80 percent of the annual volume (WHO, 2018).

In this section, we discuss some of the core features of the vaccine market that drive this difference between dollar value and volume.

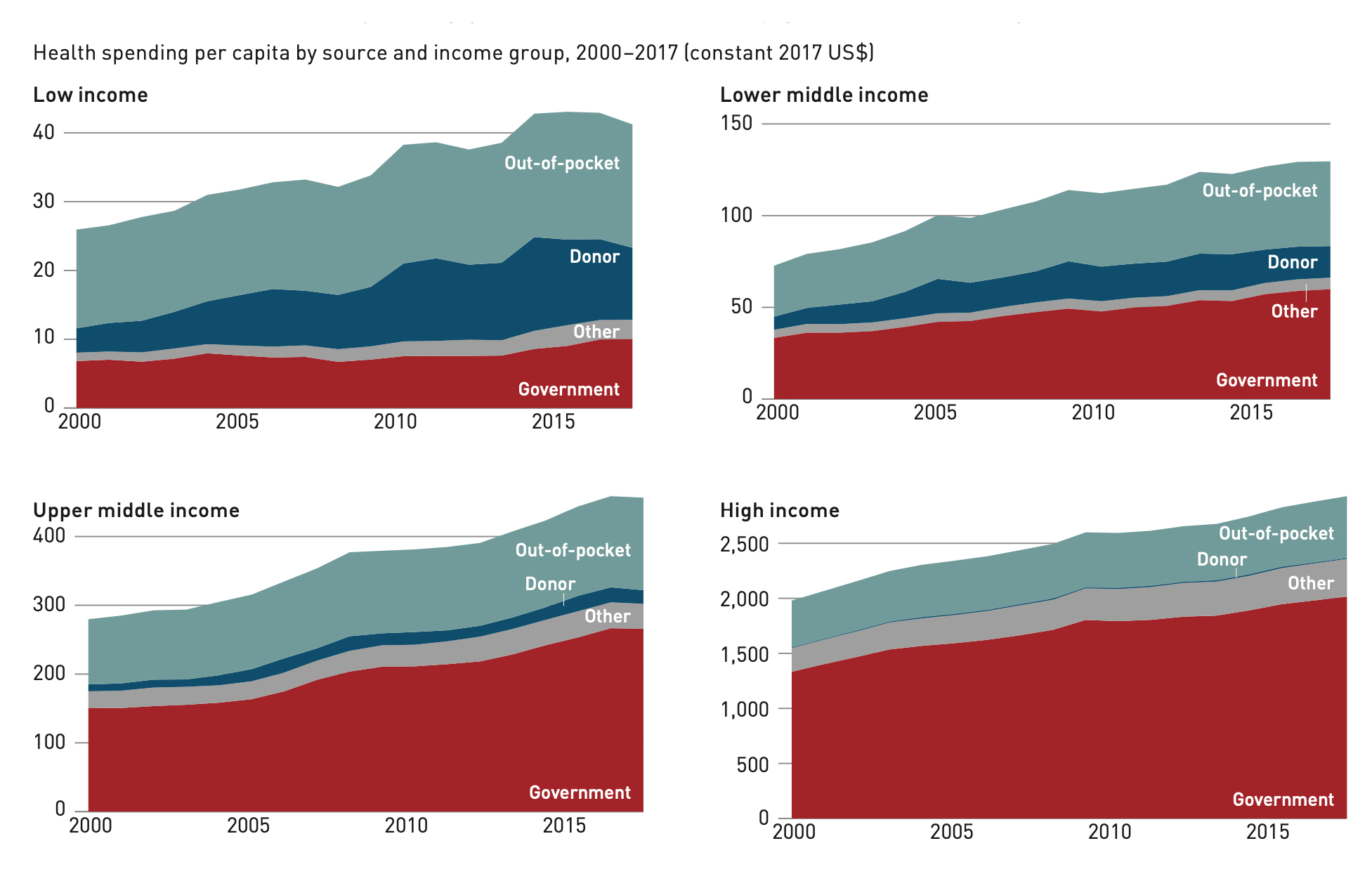

HICs spend more on health than LCIs. While government spending on health has grown everywhere over time, the spending in HICs continues to significantly outpace that of LICs and both lower- and upper-MICs (see Figure 4). Health spending in HICs and upper-MICs is also dominated by government spending, while lower-MICs and LICs rely much more on out-of-pocket expenses and donor funding. Given the dollars at play in HICs and the deep pockets of governments in these countries, it is unsurprising that these markets are more attractive to vaccine manufacturers.

Figure 4. Overall health spending growth was dominated by government funding

Source: WHO, 2019a.

Vaccine uptake is consistently high in HICs. Based on WHO-UNICEF data, the average uptake of vaccines globally varies between 39 percent for rotavirus and 90 percent for the first dose of diphtheria, tetanus and pertussis (DTP1) in 2019 (WHO, 2020d). However, these averages mask extreme disparities between regions; for example, the DTP1 coverage in most developed countries is above 90 percent, but many developing countries in Africa and Southeast Asia have coverage of less than 60 percent (UNICEF, 2020). This is partly driven by the disparity in health spending across countries with differing incomes.

The dollars and the volume tell very different stories. As noted earlier, the revenue for vaccine manufacturers tends to be generated in HICs, including North America and Europe, a marked contrast to the volume of vaccines consumed (see Figure 5). The WHO estimates that of the 3.5 million doses of vaccines consumed in 2018, the largest volumes were in the Southeast Asian and African regions, which together accounted for 45 percent of the global total. The Americas and European regions together accounted for only 26 percent of the market (WHO, 2019b).

The result is that even with relatively lower vaccine uptake, population differences result in much higher demand in low-income and middle-income countries compared to high-income countries, yet those former markets are underserved. To understand the market, there is one more critically important factor: price.

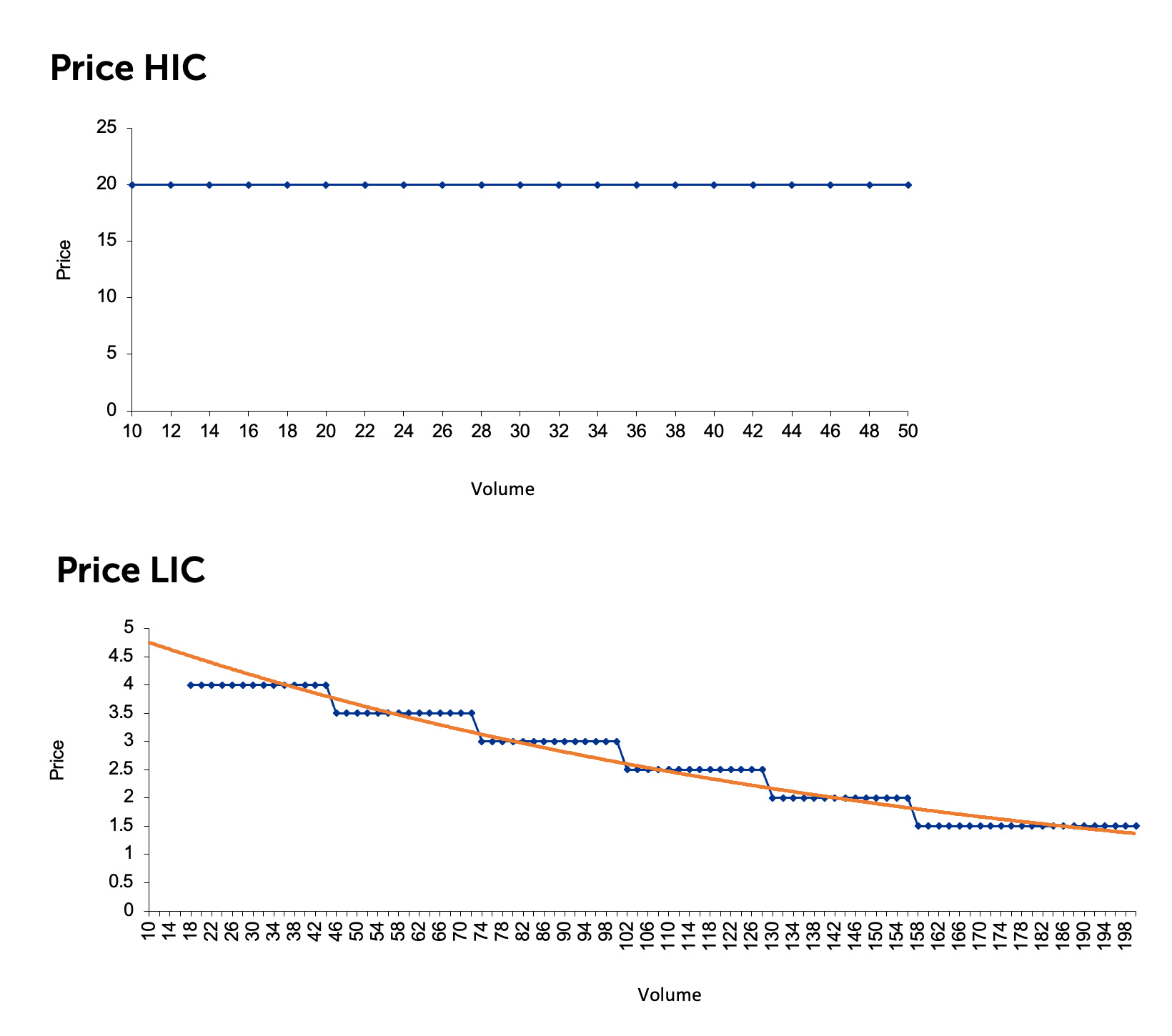

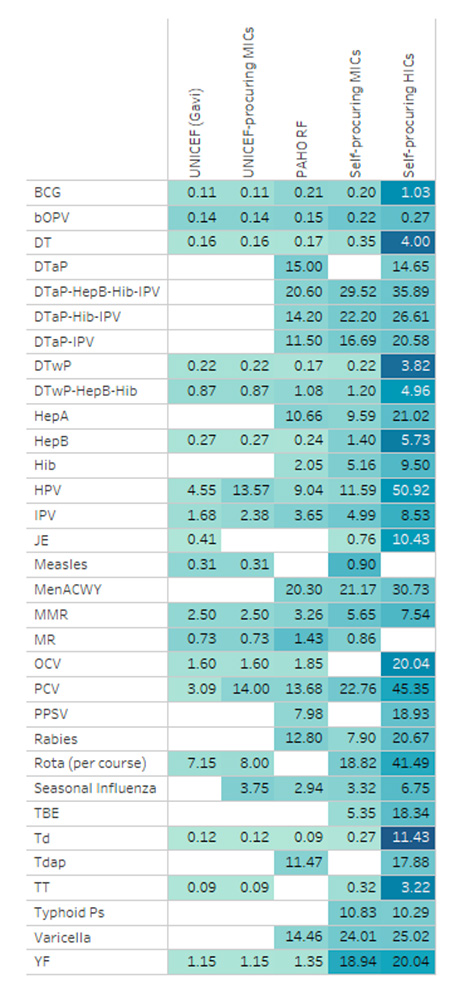

Vaccine manufacturers receive much higher prices for their products in some markets and for particular types of products. The WHO notes strong evidence of price tiering based on income level, with HICs paying prices that are more than five times higher than MICs on average (see Figure 6) (WHO, 2019b). At the same time, it is important to note inconsistencies in this pattern for individual countries and specific vaccines. Although there is less demand in HICs, they are more profitable for vaccine manufacturers.

Figure 6. Vaccine Price and Volume in HIC vs LIC Markets

Source: KPMG Economic Services, 2020.

Product type is another key point of price differentiation. While the traditional vaccines delivered to LICs and MICs continue to drive global market volume, the innovator vaccines that are primarily distributed in HICs drive global market value, largely due to the premium prices vaccines command there (WHO, 2018).

The priorities of vaccine manufacturers and public health are misaligned. In an environment subject to purely market forces, a rational vaccine manufacturer would have every incentive to prioritize the needs of HICs over those of LICs and MICs.

This is illustrated with a hypothetical example of a multinational vaccine manufacturer that has developed two vaccines but only has enough production capacity to supply one of them (see Table 1). Vaccine A provides protection against a disease with moderate symptoms that is not life-threatening and impacts 100,000 individuals globally. Vaccine B provides protection against a disease with severe symptoms that is life-threatening and impacts 1 million individuals globally. From a public health perspective, Vaccine B should clearly be the priority. In reality, this is not always the case.

| Comparisons | Vaccine A | Vaccine B |

|---|---|---|

| Disease profile | Moderate symptoms; not life threatening | Severe symptoms; life threatening |

| Potential recipients | 100,000 | 1,000,000 |

| Average price per unit | $200 | $2 |

| Revenues generated | $20,000,000 | $2,000,000 |

Source: KPMG Canada.

The key motivation for vaccine manufacturers, as with all companies, is to maximize shareholder value, which is traditionally done by maximizing profit. Whether the “shareholder” is the owner of stock in a public company or a family that owns a privately held corporation, profit remains paramount. With respect to vaccines, there are two ways to achieve this result: higher prices with lower volumes or lower prices with higher volumes. In the example above, if the potential recipients of Vaccine A are in HICs, where the product can be sold for $200 per unit, no rational manufacturer would opt to dedicate resources to Vaccine B, which can only be sold for $2.

This example illustrates the fundamental flaw in the vaccine market, in which LICs and MICs are underserved and HICs are prioritized. This is not to imply that multinational manufacturers do not supply LICs and MICs but rather that multinational manufacturers focus largely on the wealthier nations. As a result, since the 1980s, manufacturers from emerging markets have entered the market. These companies, collectively referred to as the Developing Countries Vaccines Manufacturers Network (DCVMN), play an increasingly important role in getting vaccines to LICs and MICs, supplying 55 percent of the doses procured by Gavi, the Vaccine Alliance (Gavi) between 2012 and 2018 (Pagliusi et al., 2020) and 50 percent of the doses procured by UNICEF in 2017 (Hayman and Pagliusi, 2020).

Market dynamics for multinational vaccine manufacturers are very different from those of the DCVMN companies. The volume and price available to the markets they serve vary considerably, creating two distinct sets of incentives. As noted, multinationals tend to prioritize HICs with lower volumes and higher prices, while DCVMN companies operate almost exclusively in the high-volume, low-price environments of LICs and MICs. Where similar products are supplied by both types of manufacturers, the prices charged by multinationals have historically and consistently been higher than those charged by DCVMN companies (WHO, 2019b).

Multinational Vaccine Manufacturers

Four major players — the Big Four — currently dominate the global vaccine market: GlaxoSmithKline, Sanofi, Pfizer and Merck. The list of top 10 companies is rounded out by Novartis (Switzerland), as well as biotechnology companies Emergent BioSolutions (U.S.), CSL (Australia), Inovio Pharmaceuticals (U.S.), Bavarian Nordic (Denmark) and Mitsubishi Tanabe (Japan) (Fortune Business Insights, 2020).

Four major players — the Big Four — currently dominate the global vaccine market: GlaxoSmithKline, Sanofi, Pfizer and Merck. The list of top 10 companies is rounded out by Novartis (Switzerland), as well as biotechnology companies Emergent BioSolutions (U.S.), CSL (Australia), Inovio Pharmaceuticals (U.S.), Bavarian Nordic (Denmark) and Mitsubishi Tanabe (Japan) (Fortune Business Insights, 2020).

The Big Four corporations generate 80 percent of global vaccine revenues (WHO, n.d.). Beginning in the 1970s, significant market consolidation reduced the vaccine manufacturing market from 20 companies to a handful of large ones (Kaiser Health News, 2020). For example, GlaxoSmithKline has undergone approximately six mergers and acquisitions since 1995: Wellcome (1995), Smithkline Beecham (2000), Block Drug Co. (2001), Stiefel (2009), Novartis global vaccine business (2015) and Tesaro (2018) are now all part of the corporation (GlaxoSmithKline, n.d.-a). In addition to large mergers, these dominant players have acquired a number of smaller biotech companies, such as AstraZeneca’s acquisition of Cambridge Antibody Technology, MedImmune, Spirogen and Definiens (AstraZeneca PLC, 2020).

These companies generally manufacture portfolios of vaccines, including “blockbuster” vaccine products, as well as a variety of other pharmaceutical and life science products. Blockbuster vaccines are defined as vaccines that generate more than $1 billion annually. The Big Four hold a significant  amount of intellectual property and engage in constant R&D and innovation for new vaccines, as well as improving on existing vaccines and manufacturing practices. In general, multinationals apply a portfolio approach by investing in multiple vaccine candidates and other pharmaceuticals concurrently. By working with a mix of early-stage and late-stage products, they can diversify their risks, maximize use of their manufacturing and distribution networks and smooth out their cash flows over time. However, the degree to which multinational pharmaceutical companies can leverage a portfolio approach depends on their size and extent of financial resources. For example, GlaxoSmithKline boasts a portfolio of over 30 vaccines, with another 15 vaccines in its pipeline (GlaxoSmithKline, n.d.-b, n.d.-c), while Emergent BioSolutions has a portfolio of four vaccines, with another seven in the pipeline (Emergent BioSolutions, n.d.-a., n.d.-b.).

amount of intellectual property and engage in constant R&D and innovation for new vaccines, as well as improving on existing vaccines and manufacturing practices. In general, multinationals apply a portfolio approach by investing in multiple vaccine candidates and other pharmaceuticals concurrently. By working with a mix of early-stage and late-stage products, they can diversify their risks, maximize use of their manufacturing and distribution networks and smooth out their cash flows over time. However, the degree to which multinational pharmaceutical companies can leverage a portfolio approach depends on their size and extent of financial resources. For example, GlaxoSmithKline boasts a portfolio of over 30 vaccines, with another 15 vaccines in its pipeline (GlaxoSmithKline, n.d.-b, n.d.-c), while Emergent BioSolutions has a portfolio of four vaccines, with another seven in the pipeline (Emergent BioSolutions, n.d.-a., n.d.-b.).

The conventional wisdom is that profits generated from existing operations (both vaccine and nonvaccine) are a key source of R&D funding (Garnier, 2008). In fact, global R&D spending by pharmaceutical companies was estimated to be $179 billion in 2018, with projected growth to $213 billion by 2024 (Evaluate Ltd., 2019). These funds can be directly invested into growing their own pipelines or used to buy a pipeline of new products by acquiring competitors or small startups with promising pipelines. By increasing investments in innovative, small companies, larger pharmaceutical companies can avoid direct spending on new drug development while maximizing use of their sales and marketing infrastructure (Robinson, 2020).

Small biotechnology companies and startup vaccine manufacturers provide the vaccine industry with innovation. The small biotech companies represented 31 percent of new molecular entities registered with the U.S. Food and Drug Administration (FDA) in 2009, a number that grew to 64 percent by 2018 (Robinson, 2020). Such companies are initially funded by venture capital firms or other private investors, but that funding does not always last. These organizations tend to have a very specialized focus on one or a few products but often lack the revenues or margins to generate any scale or gain market share. Generally, the larger companies with deeper pockets are better equipped to translate the innovations of smaller companies into saleable products.

Increasingly in pursuit of profitable, inorganic growth opportunities, larger companies strategically acquire startups and midsize companies to broaden their portfolios of products and services. For example, in February 2019, Bharat Biotech acquired Chiron Behring Vaccines, a clinical biotechnology company and one of the leading manufacturers of rabies vaccines around the globe (Research and Markets, 2020). Similarly, in 2017, Takeda Pharmaceutical acquired ARIAD Pharmaceuticals, which specializes in cancer medication (Research and Markets, 2020), while Sanofi acquired Shantha Biotechnics, a producer of recombinant human health care products in India (Sanofi-Aventis buys Shantha, 2009), and Protein Sciences, which develops vaccines and biopharmaceuticals against influenza and other diseases (Research and Markets, 2020).

In addition to the private market, the pharmaceutical industry draws heavily on government sources, such as the U.S. National Institutes of Health (NIH). Research indicates that every one of the 210 new drugs approved by the FDA between 2010 and 2016 received some level of NIH funding, with total funding in excess of $100 billion (Cleary et al., 2018). Another source for global pharmaceutical R&D operations are beneficial tax credits in various countries. For example, Australia offers refundable R&D tax offsets between 38 percent and 43.5 percent of costs incurred (Zehr, 2018).

Table 2 summarizes the differences between multinational vaccine manufacturers and small biotech companies.

| Company Type | Large Vaccine Manufacturers | Small Biotechnology Company |

|---|---|---|

| Product Portfolio | Diversified | May be diversified or undiversified |

| Market | LICs, MICs, and HICs | Not applicable: typically in precommercial phases and unlikely to generate any scale or gain market share |

| Margins | High | Not applicable: typically in precommercial phases and unlikely to generate any scale or gain market share |

| Source of R&D Funding | Profit from other products and Shareholder or government investment | Shareholder or government investment |

| R&D Strengths | Funding options | R&D productivity |

| R&D Weaknesses | R&D productivity | Funding options |

Developing Country Vaccines Manufacturers Network

The DCVMN, established in 2000, is a public-health-driven, international alliance of manufacturers from developing countries (DCVMN, n.d.). There are now more than 40 vaccine manufacturers in the DCVMN across 14 countries, predominantly based in India and Southeast Asia, with some manufacturers in Brazil and Africa. As the multinational vaccine manufacturers continue to turn their attention away from the lower-price low-income and middle-income markets, the DCVMN helps to ensure a consistent supply of traditional, lower-cost vaccines to developing countries, playing an increasingly important role in that supply. DCVMN vaccines comprised approximately half of UNICEF’s 2017 procurement supply by volume (Access to Medicine Foundation, 2017) and 55 percent of Gavi’s procurement supply by volume between 2012 and 2018 (Pagliusi et al., 2020).

R&D is as pressing an issue for DCVMN companies as it is for the multinationals. As of October 2019, DCVMN companies reported 181 vaccine projects in the R&D pipeline, 24 of which were for novel vaccines and 41 of which were in the last phases of clinical development. This compares to only 11 vaccines reported in late development stage in 2011 (Hayman & Pagliusi, 2020).

Unsurprisingly, the R&D conducted by DCVMN companies is much less intensive than the R&D activities of their multinational counterparts; for example, the R&D-to-sales ratio for the Big Four ranged from 14 percent to 22 percent from 2015 to 2019, compared with two percent to 16 percent for a sample of DCVMN companies during the same time period (on a much smaller revenue base).

Unlike multinationals, DCVMN companies are unable to rely as heavily on self-funding for their R&D investments, partly because of lower vaccine prices in LICs. Additionally, they typically do not have the product diversity or global sales networks to match the revenue-generating power of their multinational counterparts. As a result, they rely more heavily on volume to generate revenue, either through domestic procurement in their respective countries or international programs, such as the WHO or UNICEF prequalification.

As an alternative to self-funding, DCVMN companies rely much more heavily on public funding and blended public-private sources. Examples include milestone-based grants from the Coalition for Epidemic Preparedness Innovations (CEPI); loans, project financing or volume guarantee funding vehicles from organizations such as the Bill & Melinda Gates Foundation; and loans, equity and project financing from impact-investing funds, such as Adjuvant (Pagliusi et al., 2019).

The distinctions between large and small DCVMN companies are highlighted in Table 3.

| Company Type | Large DCVMN Company | Small DCVMN Company |

|---|---|---|

| Product Portfolio | Diversified | Undiversified |

| Market | LICs and MICs | LICs and MICs |

| Margins | Low | Low |

| Source of R&D Funding | Government investment and Public-private partnership investment | Government investment and Public-private partnership investment |

| R&D Strengths | Funding options | R&D productivity |

| R&D Weaknesses | R&D productivity | Funding options |

Source: KPMG Canada.

Understanding Demand: Shaping the Economics and Financing of the Vaccine Market

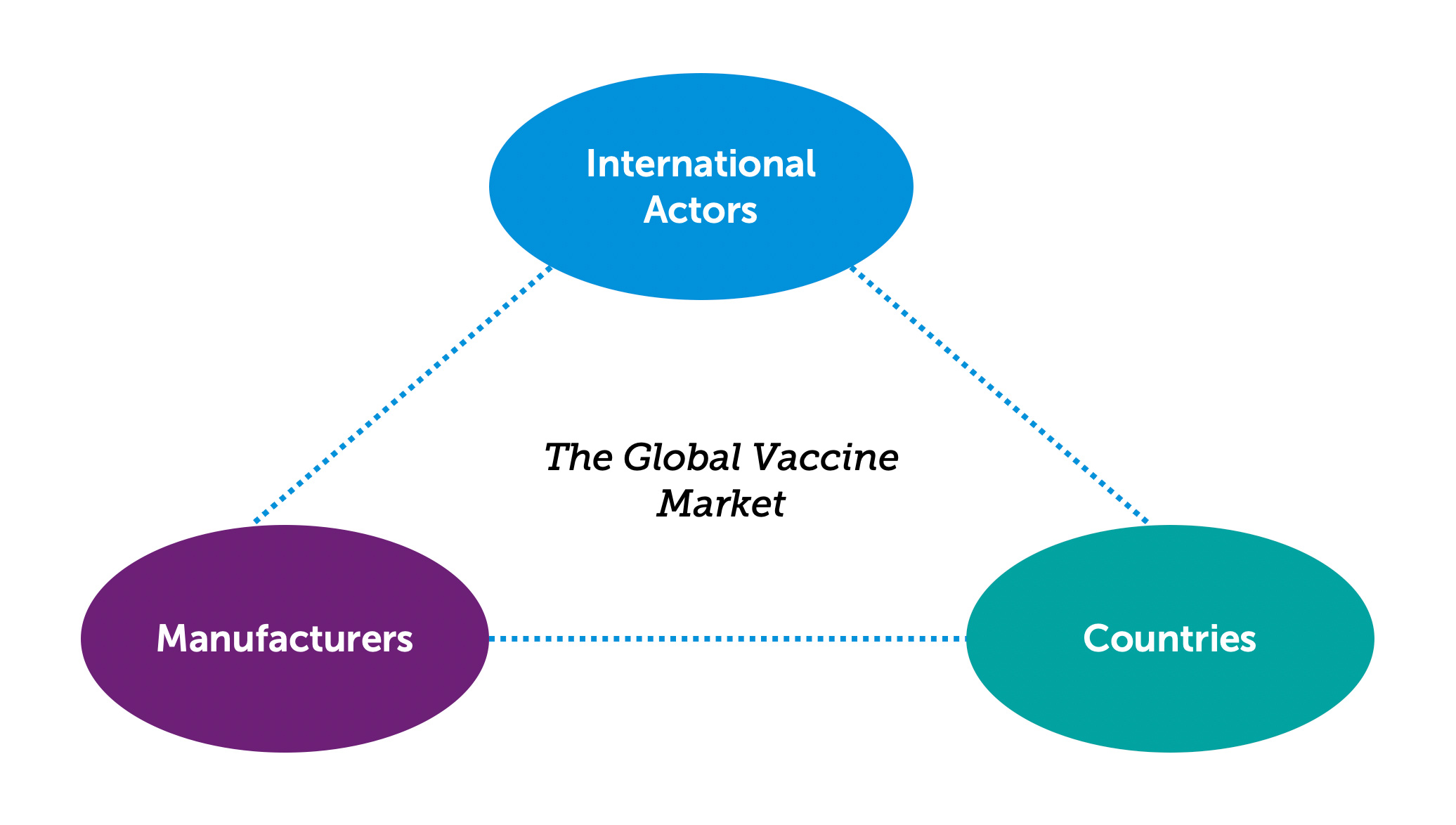

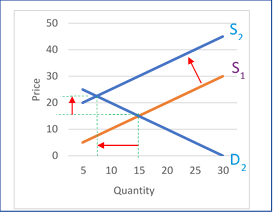

Vaccine demand is created by countries, but much like the supply side of the market, it is influenced by two differing sets of economic circumstances: those prevalent in HICs and those in LICs and MICs. As well, another group of players needs to be considered: nongovernment, nonprofit international organizations that influence the vaccine market through procurement policies and funding mechanisms (a broad group we label “international actors” in this report) (WHO, n.d.). Importantly, each of these players impacts the others (see Figure 7).

A healthy and sustainable vaccine market provides the right balance between supply (determined by vaccine manufacturers) and demand (determined by countries). International actors, the third player in this system, can impact both supply and demand, depending on the market tools used. On a global basis, the vaccine market has not reached a state of stability or equilibrium, and in many cases, vaccine security is still a concern.

The Role of Countries

The vaccine market in HICs functions reasonably well without material government intervention because the price commanded by vaccine manufacturers is enough to drive innovation and meet market demands. In those countries, government intervention is used to ensure sufficient uptake of vaccines; for example, in the vast majority of Organisation for Economic Co-operation and Development countries, the coverage for both the DTP and the measles vaccine exceeds 90 percent (Organisation for Economic Co-operation and Development, n.d.).

The story is very different in LICs and MICs. The WHO estimates that in 2019 14 million infants did not receive an initial dose of the DTP vaccine and that an additional 5.7 million were only partially vaccinated. Approximately 60 percent of these children live in 10 countries: Angola, Brazil, the Democratic Republic of the Congo, Ethiopia, India, Indonesia, Mexico, Nigeria, Pakistan and the Philippines (WHO, 2020a). There are several reasons for this gap.

Government health care spending in LICs and MICs is significantly lower than in HICs (see Figure 4). In some cases, this may be driven by conflict or disease outbreaks that prevent sustainable and consistent delivery of services. For example, in 2019, an estimated 14 million infants were still not reached by vaccination services (UNICEF, 2020). While insignificant globally (representing only 0.2 percent of total global health spending), funding from international donors continues to be important for LICs (accounting for 27 percent of health spending) and MICs (accounting for 3 percent of health spending) (WHO, 2019a).

The characteristics of a vaccine, such as thermostability, number of doses required and the serotypes targeted, can also have a significant impact on how immunization programs can be effectively implemented in low-resource settings (Access to Medicine Foundation, 2017). It may not be possible to effectively administer vaccines in LICs and MICs that are a routine part of the immunization programs of HICs.

Finally, in addition to the market incentives for vaccine manufacturers to favor HICs, supply stability continues to be a challenge for LIC and MIC markets, with frequent stockouts or stock disruptions. The impact of stockouts can be felt for several months, and only some of the lost demand is recovered (Gooding et al., 2019).

The Role of International Actors

The lack of financial incentives for vaccine manufacturers, especially multinational ones, to adequately engage in R&D and provide vaccines to LICs and MICs poses challenges that resource-strapped governments cannot address on their own. As a result, a strong network of international organizations operates in the LIC and MIC vaccine markets. These organizations use a variety of mechanisms to shape the economics and financing of the vaccine market.

International Procurement

Pooled procurement is a popular tool to generate the volume needed to attract manufacturers. Individual LICs and MICs rarely have the market power or funding to influence the decision making of vaccine manufacturers, especially multinational corporations. To bypass this constraint, a number of multilateral procurement agencies undertake vaccine procurement on their behalf (see Figure 8). Three of the largest procurement agencies are UNICEF’s Supply Division, Gavi and the Pan American Health Organization (PAHO) Revolving Fund. Each year, these organizations supply billions of doses of vaccines to LICs and MICs around the world.

Figure 8. Price per dose by procurement group

Source: WHO Global Vaccine Market Report, 2019b.

Pooled procurement is their primary tool. For example, UNICEF pools the vaccine orders of nearly 100 countries (UNICEF, 2019), and PAHO pools 41 countries (PAHO, n.d.). Other traditional procurement tools that these organizations use include multiyear contracts, demand forecasting, up-front payment bundling of products, and volume guarantees. This increases the bargaining power of LICs and MICs and gives vaccine manufacturers an incentive to supply these markets by leveraging economies of scale.

Pooled procurement has concentrated the buyer base, resulting in significant pricing pressures. Using volume as the primary mechanism, procurement agencies demand lower prices for vaccines than LICs and MICs could negotiate individually with vaccine manufacturers. In addition to pooled procurement, multinationals are subject to pricing pressures because the DCVMN gives procurement agencies a competitive alternative.

The use of the pooled procurement mechanism only for vaccines in LICs and MICs introduces the concept of a price tier for each market, which ultimately depends on country income level. An estimated 80 percent of vaccines procured through pooled mechanisms are priced below the prices available to countries that self-procure (WHO, 2018). At the same time, self-procuring HICs pay prices that average five times more than self-procuring MICs (see Figure 8) (WHO, 2018).

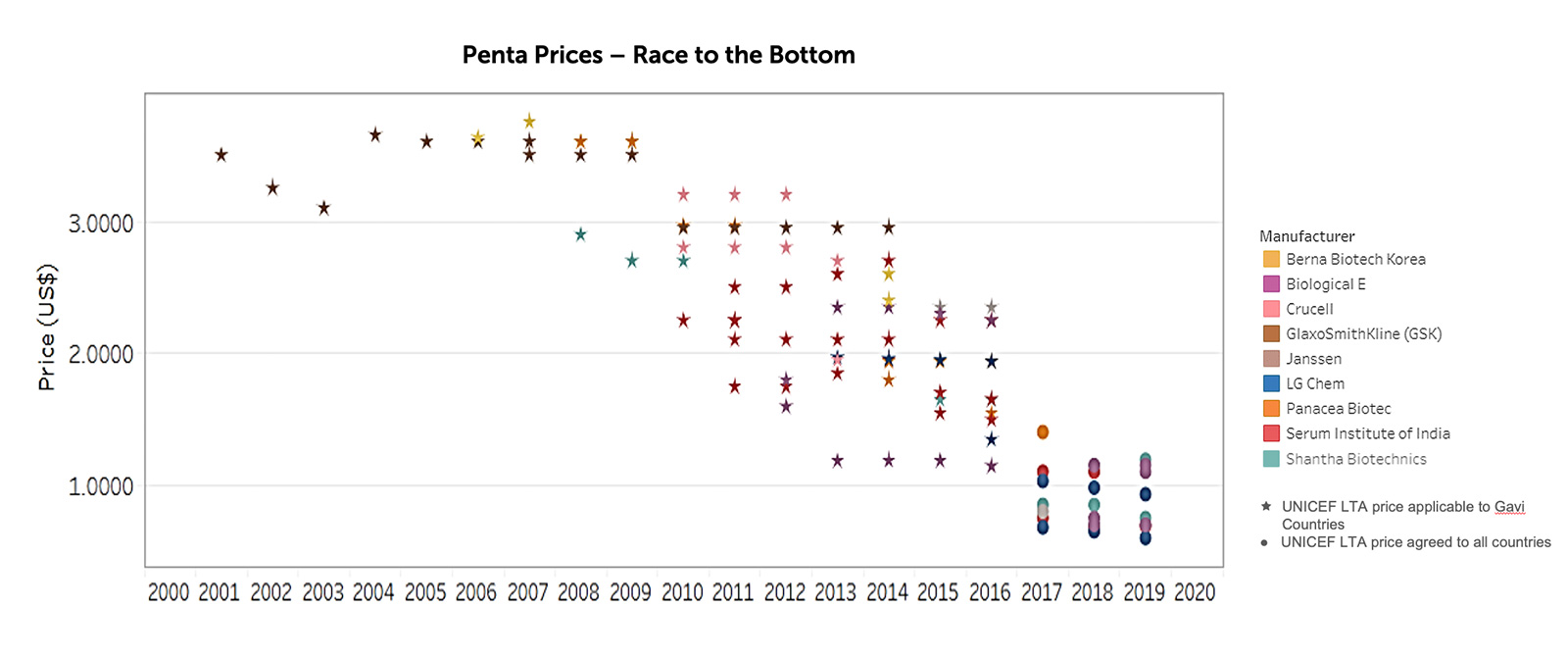

The strong emphasis on vaccine prices has made the LIC and MIC markets less viable for vaccine manufacturers. The singular focus on price has had some adverse consequences for the vaccine market. For example, through innovative procurement and funding mechanisms developed by UNICEF and Gavi, the price of the pentavalent vaccine being sold to LICs was reduced from $2.98 in 2010 to $0.79 in 2019 (see Figure 9) (UNICEF, 2019).

This price reduction has resulted in an outflux of profit-seeking vaccine manufacturers from the pentavalent market, leading to a reduced supply (see Figure 10).

Critically, this has also left insufficient margins for the remaining vaccine manufacturers to fund R&D once they pay their manufacturing costs. In addition, the extremely large sunk costs associated with vaccine production are not taken into account when manufacturers are being assessed for wider market interventions and assistance from donors and procurement agencies.

This story is expected to play out over and over in the coming years in other vaccine categories. Continued downward pricing pressure from international procurement organizations and the expectation that vaccines should cost “pennies per dose” will drive large manufacturers from the LIC and MIC markets as they cease to be viable. The circular impact of lower prices and lower margins is a disincentive for vaccine R&D targeted at LIC and MIC markets. The lower prices for vaccines mean manufacturers have very limited funds for R&D and will not invest them in a new vaccine that will also have low prices. The result is that the R&D funding bucket becomes depleted.

International Financing

Different funding and market strategies have been used by various international organizations to bolster vaccine development and access, while attempting to maintain a sustainable vaccine market. Examples of organizations operating in this space include the Bill & Melinda Gates Foundation, MedAccess, the Clinton Health Access Initiative and PATH. One of the recurring problems addressed by these organizations is the lack of incentives for vaccine manufacturers serving LICs and MICs to innovate. Some of the tools used by international organizations to encourage innovation are:

- Funding R&D and volume guarantee: Some organizations will provide no-cost or low-interest loans or grants to manufacturers to help facilitate and de-risk the R&D process in exchange for a pre-negotiated low-price vaccine. Often, the arrangement includes a volume guarantee from the funder to the manufacturer, for specific LIC markets. In return, the manufacturer agrees to a global access agreement for the intellectual property associated with the vaccine and often provides transparency into the full manufacturing costs. This tool effectively mitigates the risk of R&D failure for the manufacturer and provides a guaranteed volume level for the first few years of manufacturing, helping to break the circular impact of low prices and low margins.

- Advance market commitments: Under an advance market commitment, donors pledge to purchase a new vaccine for developing-country diseases (e.g., a malaria vaccine) at a price that would generate revenues that match other health products in a global competitive marketplace. The donors commit to paying a set price for a certain number of doses, after which the vaccine manufacturer is obligated to sell to eligible countries at an agreed-upon lower price that is affordable in the developing world.For donors, the commitment ensures that vaccines are available in the LICs and MICs that bear the biggest disease burden. This is also meant to stimulate competition among manufacturers to produce the vaccine as quickly as possible in order to claim the guaranteed price (Zandonella, 2005). However, their use has had some perverse incentives in that they have driven vaccine prices to an extremely low level without providing any backstop for the lost margin needed by manufacturers for R&D investment.

- Product development partnerships: This tool allows different members of the vaccine market to come together to innovate and develop vaccines. Partners research, develop and facilitate access to new health technologies that target diseases that disproportionately affect populations in LICs and MICs. They effectively work as a risk-sharing agreement for the vaccine developer and accelerate vaccine development by bringing together the diverse strengths of stakeholders. There are currently 16 major product development partnerships operating globally (Product Development Partnerships, 2014).

Another tool is the Access to Vaccines Index, a nonfinancial incentive created for companies to encourage improved access to their vaccines, with their contributions recognized publicly in the index. Intended as a reporting tool, it also has a public relations function for manufacturers.

The Bill & Melinda Gates Foundation is a key Gavi partner in shaping the vaccine market and is a dominant figure in creating incentives for vaccine innovation. One example of its role is CEPI, mentioned above, which provides incentives to encourage the development of vaccines to prevent and respond to future epidemics and to secure equitable access for the populations who need them. CEPI was born out of the experiences of the Ebola epidemic in West Africa, which demonstrated the need for new global mechanisms to coordinate and fund health technology R&D to meet epidemic threats where market incentives fail.

The Impact of COVID-19

In many respects, the story of the COVID-19 vaccine development process is consistent with the overall state of the vaccine industry. Manufacturers are investing hundreds of millions of dollars into developing a novel vaccine, with significant support from governments and public-private partnerships. However, the race to develop the COVID-19 vaccine has revealed some good, bad and ugly aspects of global economics and politics.

There has been unprecedented alignment between the priorities of vaccine manufacturers and public health. A key challenge in the vaccine market is that manufacturers are driven by profit potential and shareholder returns, while governments are driven by public health priorities, a prime dynamic for creative market-shaping activities. But the COVID-19 pandemic has flipped this situation on its head, with manufacturers and government aligned on the same goal at the same time.

- The Economist estimates that governments have invested upward of $10 billion in the development of a COVID-19 vaccine. While this investment is unprecedented, the number is less impressive when compared to the $7 trillion committed by governments around the world to manage the economic impact of the pandemic (The world is spending, 2020).

- Vaccine manufacturers have come together in an unprecedented manner. Just one example is an agreement between a group of six biopharmaceutical companies (Eli Lilly, AbCellera Biologics, Amgen, AstraZeneca, Genentech and GlaxoSmithKline) to exchange “technical information” on their respective manufacturing processes and platforms for COVID-19 monoclonal antibody treatments. To enable this information sharing, the U.S. Department of Justice had to issue a ruling that granted permission under antitrust laws to enable the exchange. This is a complete departure from business as usual for an industry that is famous for its secrecy (Black, 2020).

- Countries are demonstrating that they understand the need for cooperation. COVAX, a global initiative co-led by Gavi, CEPI and the WHO to accelerate the development and manufacture of COVID-19 vaccines, has the participation of 172 countries. COVAX has nine CEPI-supported vaccine candidates and nine more vaccines under evaluation. The alliance is in the process of securing funding from self-financing participants in order to secure enough doses of successful vaccines for the world’s most vulnerable populations, including health care workers and the elderly (WHO, 2020c).

Governments are using all the tools at their disposal to limit the risk of vaccine manufacturers. Risk is a key driver of decision making by vaccine manufacturers. Volume guarantees, which limit the risks and enable them to reduce prices and ensure supply security, are one of the tools that organizations such as the Bill & Melinda Gates Foundation and Gavi use (William Davidson Institute at the University of Michigan, 2015). These guarantees have been widely employed by governments during the COVID-19 pandemic, with preorders of 5.7 billion doses around the world from the five current vaccine candidates (excluding the Russian candidate). This includes pre-commitments from the United States for 700 million doses from five manufacturers, from Europe for 700 million doses from two manufacturers, from Japan for 490 million doses from three suppliers and from CEPI for 300 million doses from one manufacturer (Couronne, 2020).

Developing the vaccine is only part of the solution. Several factors complicate the ultimate objective: achieving global herd immunity. In addition to successfully developing COVID-19 vaccines, manufacturers will need to produce enough doses, pack them appropriately and get them to consumers. While manufacturers appear to be cooperating to ensure adequate manufacturing capacity, packaging is a different matter; medical glass has been in short supply since before the pandemic, and manufacturers seem to be competing to secure their own supplies. Similarly, logistics companies are struggling to keep up with demand for consumer products and medical gear and will have limited capacity for vaccine distribution (Chen, 2020).

Perhaps more alarming is the question of access to the vaccine, especially given the complex economics of the vaccine market. The same tools that maximize the possibility of a successful vaccine could lead to extreme disparities in who gets vaccinated. For example, by funding and preordering COVID-19 vaccines, HICs are taking steps to secure their own supplies but leaving out LICs and MICs that lack these resources (Chung, 2020). Despite the pooling of resources through initiatives like COVAX, many countries are taking matters into their own hands by signing their citizens up as volunteers for COVID-19 vaccine trials in a desperate attempt to ensure access. This is evident in the Philippines for Russia’s vaccine candidate (Duterte volunteers, 2020) and in Bangladesh for China’s Sinovac vaccine candidate (Paul, 2020).

COVID-19 could threaten decades of hard-won progress in the vaccine market. As governments and institutions around the world dedicate enormous amounts of money to finding a COVID-19 vaccine, multinational vaccine manufacturers and DCVMN companies are actively converting production capacity from other much-needed vaccines to ready themselves to manufacture the COVID-19 vaccine. The result remains to be seen. Will there be less funding and manufacturing capacity available for other vaccines that LICs also desperately need? How long will this disruption last? What will the resulting impact be on health and mortality?

At the same time, disruptions in delivery and uptake caused by the COVID-19 pandemic and the shutdowns in various countries have caused what the WHO and UNICEF have called “an alarming decline in the number of children receiving life-saving vaccines around the world.” In the first four months of 2020, the coverage for the third dose of the DTP vaccine (DTP3) has declined for the first time in 28 years, and there are real concerns about resurgent measles outbreaks around the globe (WHO, 2020b).

Conclusion

To summarize the key points of this paper, the complex global vaccine market is characterized by multiple actors with very different goals, and multiple markets with different needs. Manufacturers, both multinational corporations and DCVMN companies, seek profits but do so in different ways, with the former looking to lower-volume, higher-margin markets and the latter looking to higher-volume, lower-margin markets.

Multinationals have large and diverse portfolios of products, while DCVMN companies have smaller portfolios. Countries shape the demand and are the end users of the vaccines, seeking to vaccinate as much of their populations as possible. LICs and MICs have limited resources with which to buy vaccines and seek low prices but have large populations. HICs are able to pay higher prices but have smaller populations. There are also the various international actors that shape the procurement policies and funding mechanisms using different market-shaping tools. (See Table 4 for a general summary of these characteristics.)

As noted above, all of this creates growing tension. Given the differing vaccine needs in LICs and MICs compared to HICs, the impact of lower prices and lower margins continues to have a negative impact on vaccine R&D for diseases that are prevalent in developing markets. How will R&D be funded if not by manufacturers?

| Company 1 Multinational | Company 2 Start-Up | Company 3 DCVNM | Company 4 DCVNM | |

|---|---|---|---|---|

| Location | HIC | HIC | MIC | LIC |

| Product Portfolio | 30 drugs + 10 vaccines | 4 drugs + 2 vaccines | 4 drugs + 2 vaccines | 2 vaccines |

| Market | HICs, MICs, LICs | HICs | MICs, LICs | MICs, LICs |

| Revenues | $30 billion | $0 | $100 million | $10 million |

| Net Income | $7 billion | $0 | $3 million | $0.3 million |

| R&D Expenses | $5 billion | $25 million | $12 million | $1.2 million |

| Source of R&D Funding | Net income Private investment Direct and indirect government investment |

Private investment Direct and indirect government investment |

Net income Private-public partnership investment Direct and indirect government investment |

Net income Private-public partnership investment Direct and indirect government investment |

| How to Incentivize R&D? | Enable price maximization in HICs Indirect government investment |

Enable price maximization in HICs Enable private investment Direct and indirect government investment |

Enable volume maximization Enable private/public partnership investment Direct and indirect government investment |

Enable volume maximization Enable private/public partnership investment Direct and indirect government investment |

| What Disincentivizes R&D? | Low R&D productivity | Access to funding | Access to funding | Access to funding |

| Who Can Impact These Incentives and Disincentives? | Demand / markets | Funders / demand / markets | Procurement strategies / funders | Procurement strategies / funders |

Source: KPMG Canada.

COVID-19 has thrown a very interesting wrench into this system, highlighting the best and worst characteristics of the vaccine market and causing deep concern over the lasting impact of redirecting financial resources from other diseases. COVID-19 presents a truly global vaccine need, and the response reflects truly global vaccine development, but the very different abilities of countries to pay is also leading to a rise in “vaccine nationalism.”

At its core, the vaccine market behaves like any other market — it responds to supply and demand. However, unlike other markets, the impact of market failure for vaccines can literally be a matter of life or death.

Jennifer Shulman is national and Toronto lead partner of the Economic Services and Life Sciences practices of KPMG in Canada and global co-chair of KPMG IMPACT’s Measurement, Assurance and Reporting group. Her specialties include complex impact analyses, pricing, and cost/benefit issues in multiple settings, including grant applications, competitive procurement bids, government funding and policy, taxation, due diligence analyses, mergers and acquisitions, and supply chain planning. Shulman supports clients in developing and implementing impact, funding, and costing methodologies and strategies, bringing together elements of economics, statistical modeling, cost accounting and game theory/incentive alignment. She has led multiple studies for corporate, government and not-for-profit clients across industries that include health care, pharmaceuticals (including vaccines and bio-pharma), medical devices, public health, chemicals and professional services. She has a doctoral degree in international political economics from the University of Michigan.

Rowena Ahsan is a senior manager in KPMG Canada’s Economic Services team based in Montreal. For more than a decade, she has served public- and private-sector clients across a wide variety of industries, especially pharmaceutical and vaccine developers and manufacturers. Her specialties are understanding global supply chains, developing and evaluating forecasts in light of economic trends and performing scenario analyses for risk-assessment purposes. Ahsan’s work has spanned companies from large global pharmaceutical companies to small early-stage biotechnology startups, including work related to small molecule products, biologics, generics and biosimilars and drug delivery platforms. She assists clients in Canada and abroad in data gathering and economic analyses, including financial cost analyses, risk assessments, scenario design and other complex quantitative analyses. Areas of expertise include facilitating impact (cost/benefit) assessments and synthesizing results to drive evidence-based decision making by her clients. Ahsan holds a master’s degree in economics from the University of Toronto.

Kayleigh O’Malley is a manager with KPMG Canada’s Economic Services team in Toronto, with nine years’ experience with costing and economic analyses. Prior to joining the Toronto practice, she worked in the KPMG Ireland practice for four years. O’Malley has professional experience with economic costing analyses, economic evaluations and analyses, policy design, supply chain planning, dispute resolution, and mergers and acquisitions. She specializes in economics, business and strategic planning, process improvement and qualitative and quantitative research and writing. The many studies with which she has been involved cover a wide range of industries and subject matter, including global public health, pharmaceuticals, medical devices, energy, retail, mining, financial services, and information technology, and have been conducted for corporate, non-profit, and government clients. O’Malley holds a master’s degree in business economics.

References

Access to Medicine Foundation. (2017). Access to vaccines index 2017. https://accesstomedicinefoundation.org/media/uploads/downloads/5bc5eddd2d5ef_2017-Access-to-Vaccines-Index.pdf

America’s Biopharmaceutical Companies. (2020). Medicines in development: 2020 report: Vaccines. https://phrma.org/-/media/Project/PhRMA/PhRMA-Org/PhRMA-Org/PDF/medicines-in-development-for-vaccines-2020.pdf

AstraZeneca PLC. (2020, August 4). AstraZeneca PLC [Press release]. https://newsnreleases.com/2020/08/04/astrazeneca-plc/

Biotechnology Innovation Organization. (n.d.). How do drugs and biologics differ? Retrieved November 11, 2020, from https://archive.bio.org/articles/how-do-drugs-and-biologics-differ

Black, S. (2020, August 13). Sharing is caring: Why COVID-19 vaccine manufacturers must collaborate. The Science Advisory Board. https://www.scienceboard.net/index.aspx?sec=sup&sub=imm&pag=dis&ItemID=1179

Chen, E. (2020, July 30). Drugmakers race to build COVID-19 vaccine supply chain. The Wall Street Journal. https://www.wsj.com/articles/drugmakers-race-to-build-covid-19-vaccine-supply-chains-11596101586

Chung, E. (2020, August 2). Some countries may get faster access to a COVID-19 vaccine than others. Here’s why. CBC News. https://www.cbc.ca/news/health/covid-19-vaccine-countries-world-1.5668835

Cleary, E. G., Beierlein, J. M., Khanuja, N. S., McNamee, L. M., & Ledley, F. D. (2018). Contribution of NIH funding to new drug approvals, 2010–2016. Proceedings of the National Academy of Sciences of the United States of America, 115(10), 2329–2334. https://doi.org/10.1073/pnas.1715368115

Couronne, I. (2020, August 11). Pre-order of COVID-19 vaccine top five billion. CTV News. https://www.ctvnews.ca/health/coronavirus/pre-orders-of-covid-19-vaccine-top-five-billion-1.5060004

Developing Countries Vaccine Manufacturers Network. (n.d.). About. Retrieved January 13, 2020, from https://www.dcvmn.org/-About

Duterte volunteers for trial of Russian coronavirus vaccine. (2020, August 11). Al-Jazeera. https://www.aljazeera.com/news/2020/08/duterte-volunteers-trial-russian-coronavirus-vaccine-200811052359005.html

Emergent BioSolutions. (n.d.-a). Our products. Retrieved November 11, 2020, from https://www.emergentbiosolutions.com/our-products

Emergent BioSolutions. (n.d.-b). Product candidates. Retrieved November 11, 2020, from https://www.emergentbiosolutions.com/pipeline

Evaluate Ltd. (2019). EvaluatePharma®: World preview 2019, outlook to 2024. https://info.evaluate.com/rs/607-YGS-364/images/EvaluatePharma_World_Preview_2019.pdf

Fortune Business Insights. (2020, July). Vaccines market size, share & COVID-19 impact analysis, 2020–2027. https://www.fortunebusinessinsights.com/industry-reports/vaccines-market-101769

Garnier, J.-P. (2008, May). Rebuilding the R&D engine in big pharma. Harvard Business Review. https://hbr.org/2008/05/rebuilding-the-rd-engine-in-big-pharma

GlaxoSmithKline. (n.d.-a). 300 years of GSK. Retrieved November 11, 2020, from https://www.gsk.com/media/4573/300yrs-of-gsk.pdf

GlaxoSmithKline. (n.d.-b). Our pipeline. Retrieved November 11, 2020, from https://www.gsk.com/en-gb/research-and-development/our-pipeline/

GlaxoSmithKline. (n.d.-c). Our vaccines. Retrieved November 11, 2020, from https://www.gsk.com/en-gb/products/our-vaccines/

Gooding, E., Spiliotopoulou, E., & Yadav, P. (2019). Impact of vaccine stockouts on immunization coverage in Nigeria. Vaccine, 37(35), 5104–5110. https://doi.org/10.1016/j.vaccine.2019.06.006

Hayman, B., & Pagliusi, S. (2020). Emerging vaccine manufacturers are innovating for the next decade. Vaccine: X, 5, Article 100066. https://doi.org/10.1016/j.jvacx.2020.100066

The History of Vaccines. (n.d.). The development of HIV vaccines. Retrieved November 11, 2020, from https://www.historyofvaccines.org/index.php/content/articles/development-hiv-vaccines

Kaiser Health News. (2020, August 25). They pledged to donate rights to their COVID vaccine, then sold them to Pharma. https://khn.org/news/rather-than-give-away-its-covid-vaccine-oxford-makes-a-deal-with-drugmaker/

Médecins Sans Frontières. (2017, September 21). A fair shot for vaccine affordability. https://msfaccess.org/fair-shot-vaccine-affordability

Organisation for Economic Co-operation and Development. (n.d.). Child vaccination rates. Retrieved November 11, 2020, from https://data.oecd.org/healthcare/child-vaccination-rates.htm

Pagliusi, S., Che, Y., & Dong, S. (2019). The art of partnerships for vaccines. Vaccine, 37(40), 5909–5919. https://doi.org/10.1016/j.vaccine.2019.07.088

Pagliusi, S., Dennehy, M., Homma, A. (2020). Two decades of vaccine innovations for global public good. Report of the Developing Countries’ Vaccine Manufacturers Network 20th Meeting , 21–23 October 2019, Rio de Janeiro, Brazil. Vaccine, 38(36), 5851–5860. https://doi.org/10.1016/j.vaccine.2020.05.062

Pan American Health Organization. (n.d.). PAHO Revolving Fund. Retrieved November 11, 2020, from https://www.paho.org/hq/index.php?option=com_content&view=article&id=1864:paho-revolving-fund&Itemid=4135&lang=fr

Paul, R. (2020, August 27). Bangladesh approves late-stage trial of China’s Sinovac COVID-19 vaccine candidate. Reuters. https://www.reuters.com/article/us-health-coronavirus-bangladesh-china/bangladesh-approves-late-stage-trial-of-chinas-sinovac-covid-19-vaccine-candidate-idUSKBN25N2ER

Plotkin, S., Robinson, J. M., Cunningham, G., Iqbal, R., Larsen, S. (2017). The complexity and cost of vaccine manufacturing – An overview. Vaccine, 35(33), 4064–4071. https://doi.org/10.1016/j.vaccine.2017.06.003

Product Development Partnerships. (2014, September). Retrieved from http://www.finddx.org/wp-content/uploads/2016/03/PDP_Brief_ENG_final_Sep_2014.pdf

Project ALPHA. (n.d.). Estimates of clinical trial probability of success. Retrieved November 11, 2020, from https://projectalpha.mit.edu/pos/

Rappuoli, R., Black, S., Bloom, D. E. (2019). Vaccines and global health: In search of a sustainable model for vaccine development and delivery. (Working Paper No. 168). Program on the Global Demography of Aging at Harvard University. https://cdn1.sph.harvard.edu/wp-content/uploads/sites/1288/2019/07/Vaccines-and-Global-Health-In-Search-of-a-Sustainable-Model-for-Vaccine-Development-and-Delivery.pdf

Research and Markets. (2020, March 5). World vaccines market outlook to 2030 [Press release]. https://www.prnewswire.com/news-releases/world-vaccines-market-outlook-to-2030-major-players-are-astrazeneca-emergent-biosolutions-glaxosmithkline-merck-and-pfizer-301017201.html

The Review on Antimicrobial Resistance. (2016). Vaccines and alternative approaches: Reducing our dependence on antimicrobials. https://amr-review.org/sites/default/files/Vaccines%20and%20alternatives_v4_LR.pdf

Robinson, R. (2020, January). Small pharma driving big pharma innovation. PharmaVOICE. https://www.pharmavoice.com/article/2020-01-pharma-innovation/

Sanofi-Aventis buys Shantha for rs 3,740 cr. (2009, July 28). The Economic Times. https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/sanofi-aventis-buys-shantha-for-rs-3740-cr/articleshow/4827847.cms?from=mdr

Top 10 vaccine manufacturers 2019. (2020, November 30). Meticulous Blog. https://meticulousblog.org/top-10-companies-in-vaccines-market/

UNICEF. (2019). Supply annual report. Retrieved November 11, 2020, from https://www.unicef.org/supply/stories/scaling-vaccine-procurement

UNICEF. (2020, July). DTP1 coverage and number of unreached children by country, 2019. https://data.unicef.org/topic/child-health/immunization/

U.S. Department of Health and Human Services. (2020, June 16). HIV vaccines. https://www.hiv.gov/hiv-basics/hiv-prevention/potential-future-options/hiv-vaccines

William Davidson Institute at the University of Michigan. (2015). Retrospective analysis of volume guarantees in the pentavalent and rotavirus vaccine markets. https://marketbookshelf.com/wp-content/uploads/2017/06/WDI-MDSI-10.15.2015-Vaccine-VG-retrospective-analyses.pdf

World Health Organization. (n.d.). Vaccine market. Retrieved November 11, 2020, from https://www.who.int/immunization/programmes_systems/procurement/market/global_supply/en/

World Health Organization. (2018). Global vaccine market report. https://apps.who.int/iris/bitstream/handle/10665/311278/WHO-IVB-19.03-eng.pdf

World Health Organization. (2019a). Global spending on health: A world in transition. https://www.who.int/health_financing/documents/health-expenditure-report-2019.pdf

World Health Organization. (2019b). Global vaccine market report (working draft).

World Health Organization. (2020a, July 15). Immunization coverage. https://www.who.int/news-room/fact-sheets/detail/immunization-coverage

World Health Organization. (2020b, July 15). WHO and UNICEF warn of a decline in vaccinations during COVID-19 [Press release]. https://www.who.int/news-room/detail/15-07-2020-who-and-unicef-warn-of-a-decline-in-vaccinations-during-covid-19

World Health Organization. (2020c, August 24). 172 countries and multiple candidate vaccines engaged in COVID-19 vaccine Global Access Facility. https://www.who.int/news-room/detail/24-08-2020-172-countries-and-multiple-candidate-vaccines-engaged-in-covid-19-vaccine-global-access-facility

World Health Organization. (2020d, October 12). Global and regional immunization profile. https://www.who.int/immunization/monitoring_surveillance/data/gs_gloprofile.pdf

World Health Organization. (2020e, November 30). HIV/AIDS. https://www.who.int/en/news-room/fact-sheets/detail/hiv-aids

The world is spending nowhere near enough on a coronavirus vaccine. (2020, August 8). The Economist. https://www.economist.com/leaders/2020/08/08/the-world-is-spending-nowhere-near-enough-on-a-coronavirus-vaccine.

Zandonella, C. (2005). If you build it they will pay. A novel incentive called and Advance Market Commitment could help spur private sector investment in AIDS vaccine research and development. IAVIReport, 9(3), 13, 18–21. https://pubmed.ncbi.nlm.nih.gov/16276579/

Zehr, L. (2018, March 27). Australia tax incentives spurring R&D. BioTuesdays. https://biotuesdays.com/2018/03/27/2018-3-23-australia-tax-incentives-spurring-rd/